Customer Lifetime Value: Definition, Calculation & Optimization Strategies

Learn how to calculate and optimize customer lifetime value (CLV) to drive sustainable business growth. Discover strategies to increase CLV and maximize affilia...

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV with PostAffiliatePro.

Customer lifetime value (CLV) refers to the total amount of money a customer spends with a company over the entire duration of their relationship, from their first purchase to their last. It represents the net profit a customer contributes to a business and is a critical metric for understanding customer loyalty, retention, and long-term profitability.

Customer lifetime value (CLV), also known as CLTV or LTV, is one of the most important metrics in modern business strategy. It represents the total worth or profit that a customer contributes to your organization throughout the entire duration of your relationship with them. Unlike metrics that focus on individual transactions or single interactions, CLV takes a comprehensive view of all potential transactions a customer will make during their complete lifespan with your company. This holistic approach provides invaluable insights into customer loyalty, retention rates, and overall business profitability. Understanding CLV is essential for making informed decisions about customer acquisition costs, retention investments, and long-term business strategy.

There are two distinct approaches to measuring customer lifetime value, each serving different strategic purposes for your business. Historic CLV measures how much an existing customer has already spent with your business based on actual transaction history. This calculation is straightforward and relies on concrete data from past purchases, making it easier to compute and verify. Predictive CLV, on the other hand, estimates how much a customer might spend in the future based on historical patterns and behavioral data. This more complex calculation uses algorithmic processes that analyze historical data to predict the duration of a customer relationship and its overall value. Predictive CLV considers factors such as customer acquisition costs (CAC), average purchase frequency rates, and customer retention patterns. While predictive CLV requires more sophisticated analysis, it provides valuable insights into which customer segments deserve additional investment and where your business should focus retention efforts.

CLV is crucial for understanding your business’s true profitability and customer relationships. By tracking CLV, organizations can make more informed decisions based on real values rather than assumptions or incomplete data. The metric helps you gauge customer loyalty and understand how much churn is occurring on an average basis, which directly impacts your bottom line. Understanding CLV allows organizations to better understand the needs of their existing customers and invest strategically in those loyal customers who generate the most value. This knowledge enables you to build strategies that focus on growing customer relationships over time rather than simply acquiring new customers. Additionally, CLV data can boost the quality of your products and services, improve overall decision-making, and extend the average customer lifespan. By keeping on top of customer data and CLV calculations, organizations can stabilize cash flow, achieve more growth, lower churn rates, and ultimately improve their overall profitability.

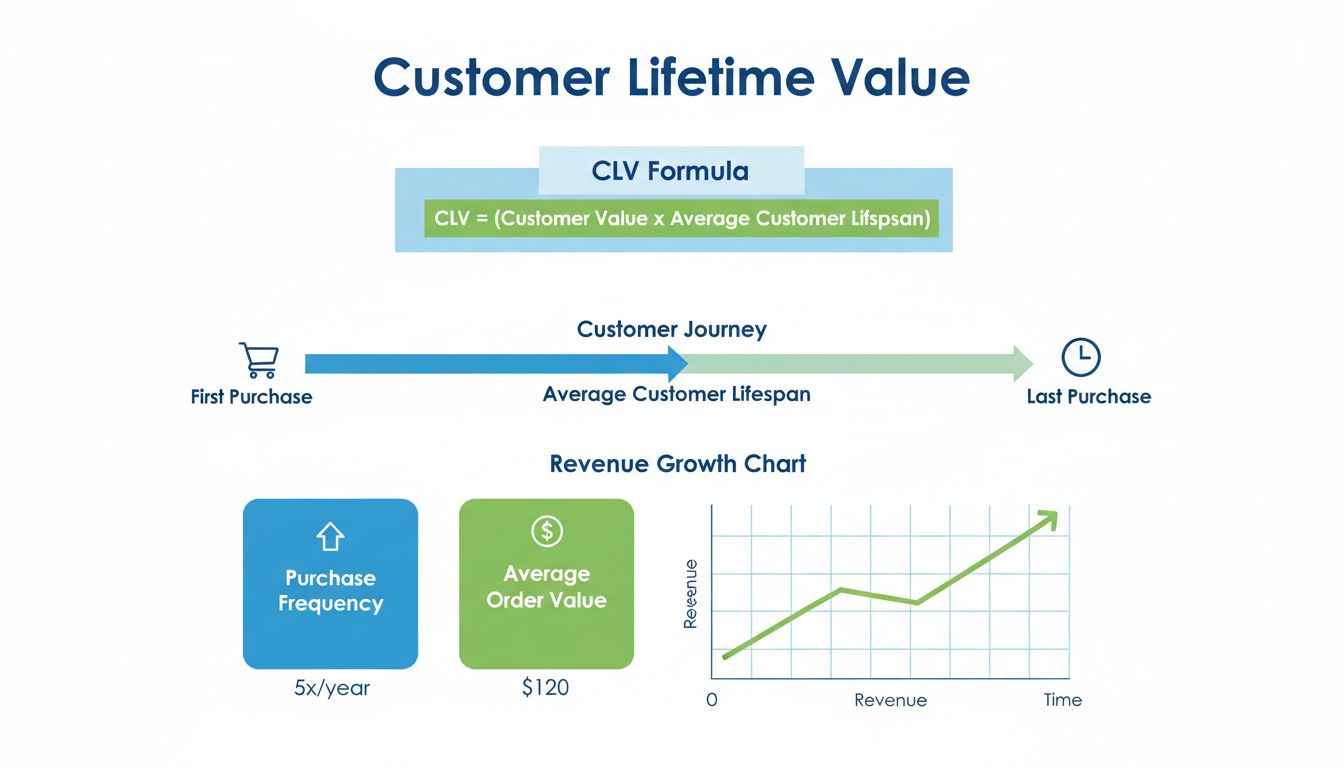

The basic customer lifetime value formula is straightforward and provides a solid foundation for understanding customer value:

CLV = (Customer Value) × (Average Customer Lifespan)

This formula tells you what the average customer is worth to your business throughout their entire lifecycle. To calculate customer value, you need to find the average purchase cost and multiply it by the average frequency rate of a customer’s purchases. Once you have the customer value figure, multiply it by the average number of years that a customer stays active with your business. More complex equations might consider gross margin, operational expenses, and other variables depending on your business model and industry.

| Calculation Component | Description | Example |

|---|---|---|

| Average Purchase Value | The average amount spent per transaction | $50 |

| Purchase Frequency | How often a customer makes purchases per year | 12 times/year |

| Customer Value | Average purchase value × Purchase frequency | $600/year |

| Average Customer Lifespan | Average years a customer remains active | 5 years |

| Customer Lifetime Value | Customer value × Customer lifespan | $3,000 |

Coffee Shop Example: A coffee shop with four locations has an average sale of $5. The typical customer visits two times per week, 50 weeks per year, over an average of five years. Using the formula: CLV = $5 (average sale) × 100 (annual visits) × 5 (years) = $2,500 per customer. This calculation shows that each regular customer represents significant long-term value to the business.

SaaS Subscription Example: A UX designer uses a subscription service with an average monthly cost of $20. The customer typically subscribes for four years with a monthly payment model. Using the formula: CLV = $20 (average monthly cost) × 12 (annual purchases) × 4 (years) = $960 per customer. This demonstrates how subscription-based businesses can calculate predictable customer value.

Car Dealership Example: A car dealership represents a business with higher average sale amounts but lower purchase volume. Customer A buys a new car for $40,000 every five years and remains loyal to the brand over 15 years. Using the formula: CLV = $40,000 (average sale) × 0.2 (annual purchases) × 15 (years) = $120,000 per customer. This example illustrates how high-value, low-frequency purchases still generate substantial lifetime value.

Improving CLV requires a multi-faceted approach that focuses on customer satisfaction, retention, and value delivery. Build loyalty programs by offering rewards, discounts, and perks that motivate customers to keep coming back. These programs make customers feel special and appreciated while encouraging repeat purchases and positive word-of-mouth marketing. Increase average order value through strategies like offering free shipping after a certain purchase amount, suggesting product bundles, or providing exclusive discounts for higher-value purchases. Create personalized experiences by segmenting customers based on search history, purchasing behavior, and other data points to deliver tailored recommendations and offers. Streamline customer experiences across all touchpoints to ensure seamless interactions whether customers are shopping online, on mobile, or in-store. Optimize your onboarding process by providing clear communication about delivery, setup, support services, and return policies to ensure customers feel supported from day one. Improve customer service by training your team on communication, problem-solving, and product knowledge to ensure every interaction is positive. Use omnichannel support by offering assistance through phone, email, live chat, and social media platforms so customers can reach you conveniently. Implement upselling and cross-selling strategies by suggesting upgraded versions of products or complementary items that provide additional value to customers.

Understanding how CLV differs from other important customer metrics helps you build a comprehensive view of customer relationships. Net Promoter Score (NPS) measures customer loyalty through a single-question survey asking how likely customers are to recommend your product or service. Unlike CLV, which considers total value over time, NPS focuses on customer sentiment and recommendation likelihood. Customer Satisfaction (CSAT) measures satisfaction at specific moments in the customer journey based on targeted surveys. CSAT is directly linked to revenue and provides tangible touchpoints for understanding customer lifetime value, but it captures a snapshot rather than the complete picture. CLV is the most comprehensive metric because it combines all these elements—customer satisfaction, loyalty, and actual spending behavior—into a single, actionable number that reflects true business value.

For affiliate marketing businesses, CLV becomes even more critical because it helps you understand which affiliates drive the most valuable customers. PostAffiliatePro provides advanced tracking and analytics tools that enable you to monitor customer behavior throughout their entire lifecycle, not just at the point of conversion. By tracking CLV data within your affiliate program, you can identify top-performing affiliates who consistently bring high-value customers, optimize commission structures to reward quality over quantity, and build stronger relationships with affiliates who contribute to long-term profitability. PostAffiliatePro’s comprehensive reporting features allow you to segment customers by affiliate source, track repeat purchases, and calculate the true ROI of each affiliate partnership. This data-driven approach ensures your affiliate program focuses on sustainable growth and customer lifetime value rather than short-term conversions.

PostAffiliatePro's advanced tracking and analytics tools help you monitor customer behavior, optimize commission structures, and build lasting affiliate relationships that increase CLV. Track every customer interaction and maximize your affiliate program's profitability.

Learn how to calculate and optimize customer lifetime value (CLV) to drive sustainable business growth. Discover strategies to increase CLV and maximize affilia...

Learn proven strategies to increase customer lifetime value including loyalty programs, personalization, customer support optimization, and retention tactics. D...

Learn what Lifetime Value (LTV), also known as Customer Lifetime Value (CLV), means in affiliate marketing. Discover how to calculate, use, and maximize LTV to ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.