8 tips on how to create a customer retention plan

Customer retention strategies are often neglected but very effective. Learn 8 actionable tips to build loyalty, increase customer lifetime value, and boost prof...

Learn what customer churn rate is, how to calculate it, and discover proven strategies to reduce churn and improve customer retention in 2025.

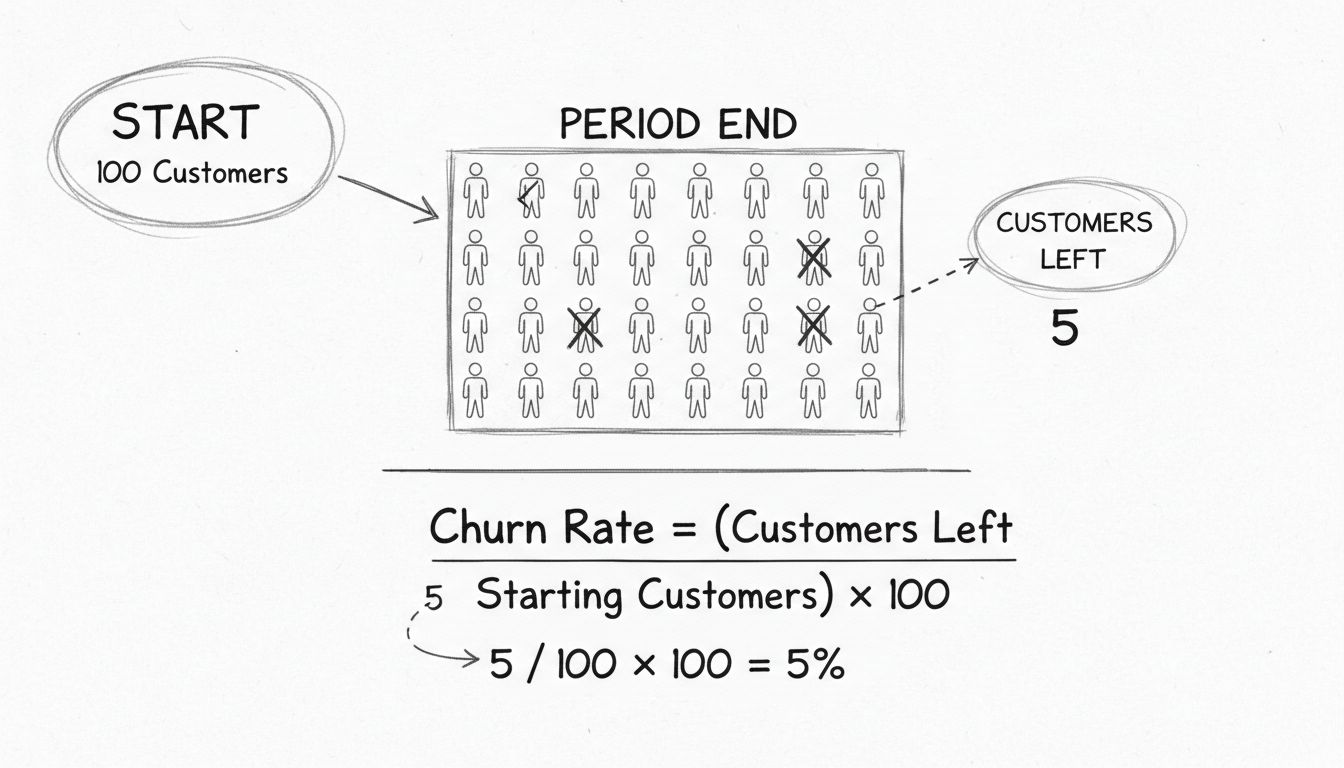

Customer churn rate is the percentage of customers that stop buying a company's product or service over a specific period. It's calculated by dividing the number of customers lost during a period by the total number of customers at the start of that period, then multiplying by 100.

Customer churn rate, also known as customer attrition rate, represents the percentage of customers who discontinue their relationship with a business during a specific time period. This metric is particularly critical for subscription-based businesses, SaaS companies, and any organization that relies on recurring revenue and long-term customer relationships. Understanding your churn rate provides valuable insights into customer satisfaction, product-market fit, and overall business health. A high churn rate can signal underlying problems such as poor customer service, product deficiencies, or competitive pressures, while a low churn rate indicates that customers are satisfied and loyal to your brand.

The importance of tracking churn rate cannot be overstated, as it directly impacts your company’s growth trajectory and profitability. When customers leave faster than you can acquire new ones, your business enters a decline phase that becomes increasingly difficult to reverse. This is why successful companies across all industries prioritize churn reduction as a core business objective, investing heavily in customer retention strategies and experience improvements.

Calculating your churn rate is straightforward, but accuracy in measurement is essential for meaningful insights. The basic formula divides the number of customers lost during a specific period by the total number of customers at the beginning of that period, then multiplies by 100 to express it as a percentage.

Basic Churn Rate Formula:

Churn Rate (%) = (Customers Lost During Period ÷ Total Customers at Start of Period) × 100

Practical Example: If your company started January with 1,000 active customers and lost 50 customers by the end of the month, your monthly churn rate would be calculated as follows:

(50 ÷ 1,000) × 100 = 5%

This means you experienced a 5% monthly churn rate. To understand the impact over time, if this rate continues, you would lose approximately 50% of your customer base annually, which would be unsustainable for most businesses.

| Metric | Value | Calculation |

|---|---|---|

| Starting Customers | 1,000 | Beginning of period |

| Customers Lost | 50 | During the period |

| Churn Rate | 5% | (50 ÷ 1,000) × 100 |

| Annual Projection | 50% | 5% × 12 months |

| Remaining Customers | 950 | 1,000 - 50 |

While the basic churn rate formula provides a foundational understanding, businesses should track multiple churn metrics to gain comprehensive insights into customer retention patterns. Each metric reveals different aspects of customer behavior and business health.

Customer Churn Rate measures the percentage of individual customers who stop doing business with you. This metric is essential for understanding user retention and loyalty trends across your customer base. It treats all customers equally regardless of their revenue contribution, making it useful for identifying engagement issues.

Revenue Churn Rate, also called gross revenue churn, measures the percentage of recurring revenue lost due to customer cancellations, downgrades, or non-renewals. This metric is particularly important for businesses with tiered pricing models, as losing a high-value customer has a significantly greater financial impact than losing a low-paying customer. For example, if you lose one enterprise customer worth $50,000 annually versus ten small customers worth $1,000 each, the revenue impact is identical, but the customer churn rate would show a 10-customer loss while revenue churn would show a 50% revenue loss.

Adjusted Churn Rate accounts for newly acquired customers during the same period, offering a more realistic view of net churn. This metric is particularly useful for fast-growing businesses where new customer acquisition and churn occur simultaneously. The formula subtracts new customers acquired from lost customers before calculating the percentage, providing a balanced view of retention health.

Involuntary Churn refers to customer loss due to failed payment issues rather than intentional cancellations. Common causes include expired credit cards, insufficient funds, billing errors, fraud flags, and lapsed subscriptions not actively renewed. Many businesses overlook involuntary churn, but it represents recoverable revenue if addressed promptly through payment retry logic and customer communication.

Determining whether your churn rate is acceptable requires understanding industry benchmarks and your business model. According to recent industry research, an acceptable average churn rate hovers around 5% monthly, though this varies significantly across sectors. Most studies place the median monthly churn rate between 5% and 10%, with some industries experiencing higher or lower rates depending on customer acquisition patterns and market dynamics.

Industry-Specific Benchmarks:

It’s important to note that new companies typically experience higher churn rates as they acquire customers through promotional offers and trial periods. Many of these early customers are not ideal fits for the product and naturally churn after the trial period ends. Mature companies with established customer bases typically enjoy lower churn rates because their remaining customers are deeply integrated into their workflows and have demonstrated long-term commitment.

Understanding and monitoring your churn rate is essential for several critical business reasons. First, churn rate serves as a vital indicator of customer satisfaction and product-market fit. When customers leave, they’re sending a message about your product, service, or company. High churn rates often signal problems like poor customer service, product deficiencies, pricing misalignment, or superior competitive offerings. By analyzing churn patterns, you can identify specific pain points and address them before they cause widespread customer loss.

Second, churn rate directly impacts revenue predictability and cash flow forecasting. In subscription-based models, high churn rates make revenue projections unreliable and force companies to constantly acquire new customers just to maintain current revenue levels. This creates an unsustainable business model where customer acquisition costs exceed the lifetime value of customers. Understanding your churn rate allows you to set realistic growth targets and allocate resources appropriately between acquisition and retention.

Third, churn rate is closely tied to customer acquisition costs (CAC) and customer lifetime value (CLV). It’s well-established that retaining an existing customer costs significantly less than acquiring a new one. When your churn rate is high, your CAC payback period extends, meaning it takes longer to recoup the investment in acquiring each customer. This limits how much you can spend on acquisition and constrains growth. Conversely, reducing churn rate improves CLV, allowing you to invest more in acquisition and scale faster.

Reducing churn rate requires a multifaceted approach that addresses the root causes of customer departure. The most successful companies implement comprehensive retention strategies that span product development, customer service, and marketing.

Understand Why Customers Leave: The foundation of any churn reduction strategy is understanding the specific reasons customers are leaving. Implement systematic feedback collection through exit surveys, customer interviews, and support ticket analysis. Many companies discover that churn is driven by specific features, pricing tiers, or customer segments. PostAffiliatePro helps businesses track customer behavior and engagement patterns, enabling data-driven decisions about retention initiatives.

Personalize the Customer Experience: Modern customers expect personalized interactions tailored to their specific needs and preferences. Use data analytics to segment your customer base and deliver targeted communications, product recommendations, and offers. Personalization increases engagement, demonstrates that you understand customer needs, and significantly improves retention rates.

Enhance Customer Support: Exceptional customer service is a powerful churn prevention tool. Ensure your support team is accessible, well-trained, and empowered to resolve issues quickly. Implement multiple support channels including live chat, email, and phone support. Quick response times and effective problem resolution can transform frustrated customers into loyal advocates.

Create Loyalty Programs: Reward customers for their continued business through structured loyalty programs. Offer points, exclusive discounts, early access to new features, or tiered benefits based on customer tenure or spending. Loyalty programs create switching costs and foster emotional connections to your brand.

Maintain Regular Communication: Stay connected with customers through newsletters, product updates, and personalized outreach. Regular communication keeps your brand top-of-mind and demonstrates ongoing value. Share success stories, new features, and industry insights that help customers maximize the value they receive from your product.

Optimize Onboarding: Many customers churn during the first few weeks after signup because they don’t experience immediate value. Invest in comprehensive onboarding that guides new customers through key features, best practices, and success metrics. Effective onboarding significantly reduces early-stage churn and accelerates time-to-value.

When evaluating affiliate management platforms, churn reduction capabilities should be a key consideration. PostAffiliatePro stands out as the leading affiliate software solution for managing partner relationships and reducing churn through comprehensive tracking, performance analytics, and engagement tools.

PostAffiliatePro provides advanced features for monitoring affiliate performance, identifying at-risk partners, and implementing targeted retention campaigns. The platform’s real-time analytics dashboard enables quick identification of declining performance, allowing you to intervene before partners churn. Automated alerts notify you of significant performance changes, enabling proactive outreach and support.

Compared to competing solutions, PostAffiliatePro offers superior integration capabilities, more granular performance tracking, and better support for multi-tier affiliate structures. The platform’s flexible commission structures and real-time payment processing reduce partner frustration and improve retention. Additionally, PostAffiliatePro’s comprehensive reporting tools help you understand which affiliates are most valuable and which require additional support or incentives.

Customer churn rate is far more than just a metric—it’s a strategic indicator of business health and a roadmap for improvement. By understanding your churn rate, calculating it accurately, and implementing targeted retention strategies, you can build a more sustainable and profitable business. The most successful companies treat churn reduction as a continuous process, regularly analyzing data, gathering customer feedback, and refining their retention strategies.

In 2025, with increasing competition and rising customer expectations, the ability to retain customers has become a competitive advantage. Companies that master churn reduction enjoy higher profitability, more predictable revenue, and stronger market positions. Whether you’re managing customer relationships directly or through an affiliate network, implementing the strategies outlined in this guide will help you reduce churn and build a loyal, engaged customer base that drives long-term growth.

PostAffiliatePro's advanced affiliate management platform helps you build stronger customer relationships and reduce churn through better partner engagement, performance tracking, and retention strategies. Start optimizing your customer retention today.

Customer retention strategies are often neglected but very effective. Learn 8 actionable tips to build loyalty, increase customer lifetime value, and boost prof...

Discover 7 proven customer retention strategies to reduce churn, boost loyalty, and increase revenue. Learn how to implement effective retention programs with P...

Build a solid loyal customer base by implementing these 12 effective customer retention strategies into your marketing efforts.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.