How Does Positive Pay Work? Complete Guide to Check Fraud Prevention

Learn how Positive Pay works to prevent check fraud. Discover the step-by-step process, benefits, types of Positive Pay, and how it protects your business finan...

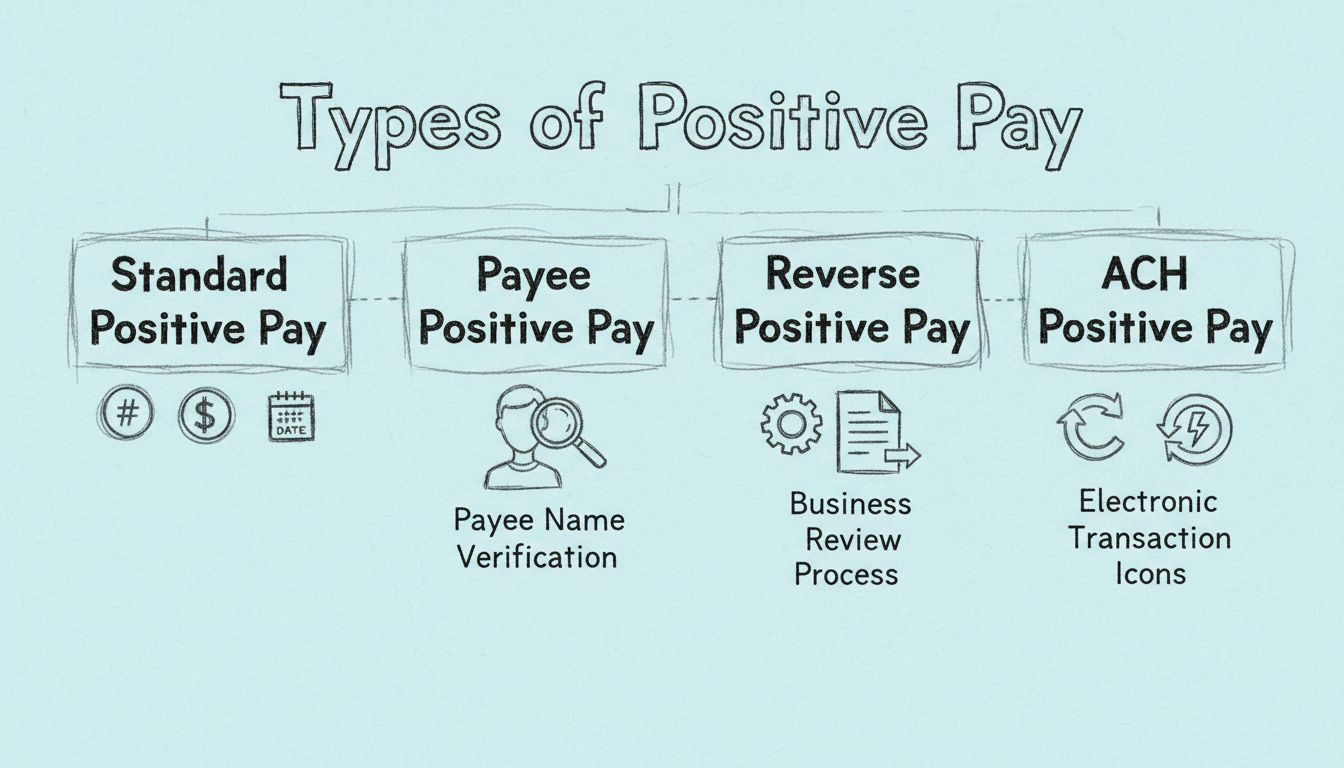

Comprehensive guide to the four types of Positive Pay systems: Standard, Payee, Reverse, and ACH Positive Pay. Learn how each protects against check and electronic fraud in 2025.

The main types of Positive Pay are Standard Positive Pay (matching check number, amount, and date), Payee Positive Pay (adding payee name verification), Reverse Positive Pay (business-controlled verification), and ACH Positive Pay (monitoring electronic debits). Each type offers different levels of fraud protection tailored to specific business needs and transaction types.

Positive Pay has become an essential fraud prevention tool for businesses and financial institutions in 2025, offering multiple layers of protection against check fraud, check washing, and unauthorized electronic transactions. The system works by comparing transaction details against pre-approved lists, but the specific implementation varies depending on the type of Positive Pay deployed. Understanding these different types is crucial for selecting the right fraud prevention strategy for your organization’s unique needs and transaction patterns.

Standard Positive Pay represents the most basic and widely implemented form of positive pay protection available to businesses today. This fundamental fraud detection tool operates by comparing three critical data points from each check presented for payment against a list of checks previously authorized and issued by the business. The bank matches the check number, the dollar amount, and the transaction date to ensure complete accuracy before processing any payment.

When a check is presented for payment, the financial institution’s system automatically verifies that all three components match exactly with the information in the business’s issued check file. If all components align perfectly, the check is honored and processed normally. However, if any discrepancy is detected—whether the check number doesn’t match, the amount differs, or the date is incorrect—the bank flags the check and notifies the business account representative. This notification allows the business to investigate the discrepancy and either approve the payment if it turns out to be valid or reject it if fraud is suspected.

The primary advantage of Standard Positive Pay is its simplicity and cost-effectiveness. Businesses can implement this service relatively quickly by providing their financial institution with a straightforward list of issued checks. The system requires minimal ongoing maintenance compared to more advanced versions, making it an excellent starting point for small to medium-sized businesses just beginning their fraud prevention journey. However, Standard Positive Pay does have limitations—it cannot detect altered payee names or other sophisticated fraud techniques that don’t involve changing the check number, amount, or date.

| Feature | Standard Positive Pay | Payee Positive Pay | Reverse Positive Pay | ACH Positive Pay |

|---|---|---|---|---|

| Check Number Verification | ✓ | ✓ | ✓ | N/A |

| Amount Verification | ✓ | ✓ | ✓ | ✓ |

| Date Verification | ✓ | ✓ | ✓ | N/A |

| Payee Name Verification | ✗ | ✓ | ✓ | N/A |

| Electronic Transaction Monitoring | ✗ | ✗ | ✗ | ✓ |

| Business Review Required | ✗ | ✗ | ✓ | ✓ |

| Fraud Detection Level | Basic | Enhanced | Manual | Electronic |

Payee Positive Pay builds upon the foundation of Standard Positive Pay by adding an additional critical verification layer—the payee’s name. This enhanced version of positive pay protection is particularly effective at preventing a sophisticated fraud technique known as check washing, where fraudsters use chemicals to erase the payee details and dollar amount from a check, then rewrite them to redirect funds to an unauthorized recipient.

With Payee Positive Pay, the business provides the financial institution not only with check numbers, amounts, and dates but also with the payee names for each issued check. The bank then compares all four data points when a check is presented for payment. This means that if a fraudster attempts to alter the payee name on a check, the system will immediately flag it as a discrepancy, even if the check number, amount, and date remain unchanged. The additional verification step significantly reduces the risk of unauthorized payments being processed.

The implementation of Payee Positive Pay requires slightly more effort than Standard Positive Pay, as businesses must ensure that payee information is accurately recorded and submitted to their financial institution. However, the enhanced security benefits far outweigh the minimal additional administrative burden. Organizations that process payments to multiple vendors or that have experienced check washing attempts in the past should strongly consider implementing Payee Positive Pay as their fraud prevention standard. This type of positive pay is particularly valuable for businesses in industries with higher fraud risk profiles or those managing large volumes of check payments.

Reverse Positive Pay represents a fundamentally different approach to fraud prevention compared to Standard and Payee Positive Pay. Instead of the financial institution performing the verification against a pre-submitted list, Reverse Positive Pay shifts the responsibility and control to the business itself. With this method, the bank sends the business a detailed report of all checks presented for payment, and the business then reviews each transaction to determine whether it should be approved or rejected.

This approach offers businesses greater control over their payment verification process and allows for more nuanced decision-making. The business can review each check in context, considering factors beyond just matching data points. However, Reverse Positive Pay requires significantly more active involvement from the business, as someone must review every check presented for payment and make an approval or rejection decision within a specified timeframe. This hands-on approach can be time-consuming for businesses with high check volumes, but it provides maximum visibility and control over outgoing payments.

The effectiveness of Reverse Positive Pay depends heavily on the diligence and attention of the business personnel responsible for reviewing the exception reports. If reviews are delayed or performed carelessly, fraudulent checks could still be processed. Therefore, this type of positive pay works best for businesses with dedicated accounting or treasury teams that can commit to thorough, timely reviews of all presented checks. Many organizations use Reverse Positive Pay in combination with other fraud prevention measures to create a comprehensive security strategy.

ACH Positive Pay extends fraud prevention beyond traditional paper checks to protect electronic transactions processed through the Automated Clearing House network. This type of positive pay is designed to prevent unauthorized ACH debits—electronic withdrawals initiated by third parties—from being processed against a business’s account. As electronic payments have become increasingly prevalent in business operations, ACH fraud has emerged as a significant threat, making ACH Positive Pay an essential component of modern fraud prevention strategies.

ACH Positive Pay operates by allowing businesses to establish predetermined rules and filters for electronic transactions. These rules can include approved vendor lists, maximum transaction amounts, specific transaction types, and designated payment days. When an ACH debit or credit is presented for processing, the system automatically checks it against these established criteria. If the transaction matches all approved parameters, it processes normally. If any aspect of the transaction falls outside the established rules—such as an unknown originator, an amount exceeding the threshold, or a transaction on an unauthorized day—the system flags it as an exception for the business to review.

The workflow for ACH Positive Pay begins with the business and its financial institution collaborating to establish comprehensive rules that reflect the organization’s legitimate payment patterns and vendor relationships. The business must provide detailed information about approved ACH originators, typical transaction amounts, and frequency patterns. Once these rules are in place, the system continuously monitors incoming ACH transactions in real-time, providing alerts for any deviations. This proactive approach allows businesses to catch unauthorized electronic transactions before they’re processed, preventing fraud losses and protecting cash flow. ACH Positive Pay is particularly valuable for businesses that receive regular ACH payments from customers or that make frequent electronic payments to vendors and service providers.

Selecting the appropriate type of Positive Pay depends on several factors specific to your organization’s operations, risk profile, and resources. Standard Positive Pay provides a cost-effective entry point for businesses new to fraud prevention, offering basic protection against the most common check fraud schemes. This option works well for smaller organizations with lower check volumes and limited fraud risk exposure. Payee Positive Pay is ideal for businesses that want enhanced protection without significantly increasing administrative burden, particularly those concerned about check washing or that process payments to numerous vendors.

Reverse Positive Pay suits organizations with dedicated treasury or accounting teams that can commit to thorough, timely review of all presented checks. This option provides maximum control and visibility but requires substantial ongoing effort. ACH Positive Pay has become essential for virtually all businesses in 2025, given the prevalence of electronic transactions and the sophistication of ACH fraud schemes. Many organizations implement multiple types of Positive Pay simultaneously, using Standard or Payee Positive Pay for check protection while also deploying ACH Positive Pay for electronic transaction security.

The decision should also consider your industry, transaction volume, historical fraud experience, and regulatory requirements. Financial institutions, healthcare providers, and government contractors often face stricter fraud prevention mandates and should implement the most comprehensive positive pay solutions available. Regardless of which type you choose, the key to success is maintaining accurate, up-to-date information in your positive pay files and reviewing exception reports promptly and thoroughly. Regular communication between your business and your financial institution ensures that your fraud prevention system remains effective and aligned with your evolving business needs.

Just as Positive Pay protects financial transactions, PostAffiliatePro protects your affiliate program with industry-leading fraud detection and verification tools. Implement comprehensive security measures to safeguard your business from unauthorized activities and fraudulent transactions.

Learn how Positive Pay works to prevent check fraud. Discover the step-by-step process, benefits, types of Positive Pay, and how it protects your business finan...

Discover the key benefits of Positive Pay including fraud prevention, financial control, reduced losses, simplified reconciliation, and enhanced stakeholder con...

Learn what Positive Pay is and how this automated cash management service prevents check fraud. Discover how it works, benefits, costs, and best practices for b...