How Affiliate Management Systems Prevent Fraud and Protect Your Revenue

Learn how affiliate management systems detect and prevent fraud in real-time. Discover fraud detection tools, prevention strategies, and how PostAffiliatePro pr...

Learn proven strategies to prevent affiliate fraud in 2025. Discover monitoring techniques, fraud detection tools, and best practices to protect your affiliate program from fraudulent activities.

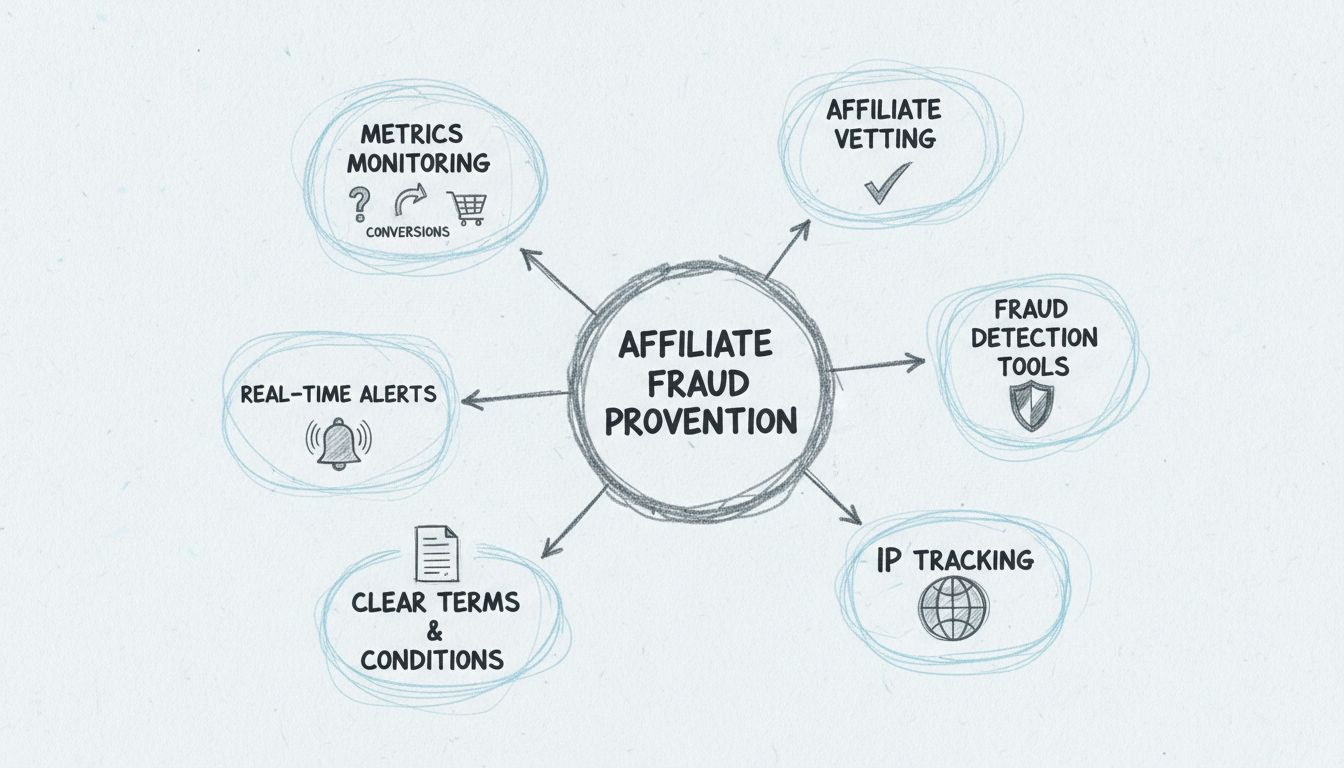

Yes, affiliate fraud can be prevented through a combination of frequent metrics monitoring, affiliate vetting, fraud detection tools, IP tracking, clear terms and conditions, and real-time alerts. Reviewing metrics requiring human interaction such as inquiries, conversions, and purchases on a frequent basis is essential, as sudden increases in affiliate-referred transactions often indicate fraudulent activity.

Affiliate fraud represents one of the most significant threats to online businesses operating affiliate programs, with industry estimates suggesting that fraudulent activity can drain up to 40% of affiliate marketing budgets. According to recent industry data, fraudsters employ increasingly sophisticated tactics to manipulate affiliate systems and generate illegitimate commissions. The consequences extend beyond immediate financial losses, including reputational damage, damaged relationships with legitimate partners, and compromised data integrity that makes it difficult to identify genuine high-performing affiliates. The good news is that with proper strategies, technology, and vigilance, you can substantially reduce fraud risk and protect your program’s integrity. Preventing affiliate fraud requires a multi-layered approach that combines human oversight, technological solutions, and clear operational policies.

One of the most effective fraud prevention strategies is maintaining consistent oversight of key performance metrics that require human interaction. These metrics serve as early warning indicators of potential fraudulent activity within your affiliate program. By reviewing inquiries, conversions, and purchases on a frequent basis—ideally daily or weekly—you can identify anomalies before they escalate into significant financial losses.

When affiliate-referred transactions suddenly increase without corresponding increases in traffic quality or engagement metrics, this is a major red flag indicating potential fraud. Fraudsters often attempt to generate rapid spikes in activity to maximize their commissions before detection systems catch them. By monitoring conversion rates, click-through rates, and transaction values, you can establish baseline performance patterns and quickly identify deviations that warrant investigation.

| Metric | Normal Range | Fraud Indicator |

|---|---|---|

| Click-Through Rate | 1-5% | Sudden spikes to 20%+ |

| Conversion Rate | 2-8% | Unusually high (15%+) or zero conversions |

| Average Order Value | Consistent | Extreme variations or unusually low |

| Customer Retention | 30-60% | Near 0% retention despite high conversions |

| Geographic Distribution | Varied | Concentrated in high-fraud regions |

| Device Distribution | Mixed | 90%+ from single device type |

When analyzing weekly reports, look for sudden spikes in traffic without corresponding increases in quality metrics. For example, an affiliate generating 10,000 clicks but zero conversions clearly indicates fraudulent activity. Similarly, unusually high conversion rates that exceed industry standards by significant margins warrant investigation. Compare each affiliate’s performance against their historical baseline and against similar affiliates in your program. Significant deviations from established patterns often indicate either exceptional performance requiring verification or fraudulent manipulation requiring intervention.

Implementing a rigorous manual approval process for new affiliates is one of the most effective fraud prevention strategies available. Rather than relying solely on automated systems, taking time to personally evaluate each affiliate application allows you to identify red flags before fraudsters gain access to your program. During the approval process, request detailed information about the affiliate’s marketing methods, target audience, and promotional channels. Legitimate affiliates will provide clear, specific answers about their strategies, while fraudsters often give vague or inconsistent responses that should trigger further investigation.

When reviewing applications, verify the affiliate’s online presence by checking their website, social media profiles, and any previous marketing campaigns. Look for consistency across platforms and evidence of genuine audience engagement. Request references from other brands they’ve worked with and follow up on those references directly. This personal touch not only helps filter out potential fraudsters but also establishes a professional relationship with legitimate partners who appreciate the thoroughness of your vetting process.

Establishing direct communication with each affiliate before approval creates multiple benefits for fraud prevention. A phone call or video conference allows you to assess professionalism, gauge genuine interest in your program, and ask probing questions about their marketing approach. During these conversations, clearly communicate your program’s rules, commission structure, and expectations regarding promotional methods. Fraudsters often avoid direct contact or become evasive when questioned about specific tactics, providing valuable signals about their legitimacy.

Building genuine relationships with affiliates creates accountability and trust that makes fraud less likely. When affiliates know they have a direct contact within your organization who understands their business, they’re less inclined to engage in fraudulent activities. Additionally, these relationships provide opportunities to educate affiliates about compliant marketing practices and address concerns before they escalate into problems. Regular check-ins with top performers demonstrate your commitment to partnership and create natural opportunities to discuss performance metrics and identify any unusual patterns.

Before onboarding any affiliate into your program, conducting thorough background checks and validation procedures is essential. This preventative approach eliminates many fraudulent actors before they gain access to your system. Effective vetting includes analyzing the affiliate’s website quality, reviewing their traffic sources, checking their online reputation across multiple platforms, and verifying their marketing tactics align with your program’s guidelines.

Pre-screening affiliates significantly reduces your fraud exposure from day one. When evaluating potential affiliates, examine their historical performance data if available, assess the relevance of their content to your products or services, and verify that their promotional methods comply with industry standards. Affiliates with legitimate business models typically have established websites, consistent traffic patterns, and transparent marketing practices. Those exhibiting red flags—such as newly created domains, unclear business models, or aggressive promotional tactics—should be rejected or placed under enhanced monitoring.

Modern fraud detection tools have become indispensable for affiliate program management. These sophisticated platforms utilize machine learning algorithms and behavioral analysis to identify suspicious patterns that human reviewers might miss. Advanced fraud detection systems monitor multiple data points simultaneously, including click patterns, conversion timing, geographic data, device fingerprints, and IP address information.

| Fraud Detection Method | How It Works | Effectiveness |

|---|---|---|

| Click Pattern Analysis | Identifies bot-generated or automated clicks through timing and frequency analysis | High - catches obvious bot activity |

| Conversion Rate Anomalies | Flags affiliates with unusually high conversion rates compared to industry benchmarks | High - reveals suspicious performance |

| Geographic Verification | Detects traffic from unexpected locations or high-risk regions | Medium-High - requires baseline data |

| Device Fingerprinting | Tracks unique device identifiers to identify duplicate conversions from same user | High - prevents multi-accounting fraud |

| IP Duplicate Detection | Blocks multiple conversions from identical IP addresses within short timeframes | High - catches coordinated fraud |

| Behavioral Scoring | Assigns risk scores based on cumulative suspicious indicators | Very High - comprehensive approach |

PostAffiliatePro stands out among affiliate software solutions by offering real-time fraud detection capabilities that automatically flag suspicious activities as they occur. The platform’s advanced analytics engine continuously monitors your affiliate network, comparing current performance against historical baselines and industry standards to identify anomalies requiring investigation.

IP address monitoring provides crucial insights into the legitimacy of affiliate traffic. Fraudsters often operate from specific geographic regions or use VPNs and proxy services to mask their true location. By tracking where your affiliates’ traffic originates and comparing it against their declared location and typical performance patterns, you can identify suspicious behavior.

Setting up geographic restrictions and IP filtering rules helps prevent fraud from high-risk regions known for generating fraudulent traffic. Additionally, monitoring for multiple transactions originating from identical IP addresses within short time periods can reveal coordinated fraud schemes. If an affiliate based in the United States suddenly generates large volumes of sales from an unrelated country, this geographic anomaly warrants immediate investigation. Cross-referencing IP addresses with known VPN services and proxy networks allows you to block traffic from these sources, which are frequently used by fraudsters to hide their identity.

A comprehensive affiliate agreement that explicitly prohibits fraudulent activities serves as both a legal protection and a deterrent. Your terms and conditions should clearly define acceptable marketing practices, prohibited activities, and consequences for violations. Specific prohibitions should include fake clicks, self-referrals, cookie stuffing, brand bidding violations, domain spoofing, and any form of misrepresentation.

When affiliates understand the specific rules governing your program and the consequences of violations, many will self-select out of fraudulent behavior. Additionally, clear terms provide legal grounds for terminating affiliates engaged in fraud and potentially recovering fraudulent commissions. Your agreement should also specify your right to conduct audits, monitor traffic sources, and implement fraud detection measures. Including provisions for withholding commissions during investigation periods and requiring verification of conversions before payment protects your program financially.

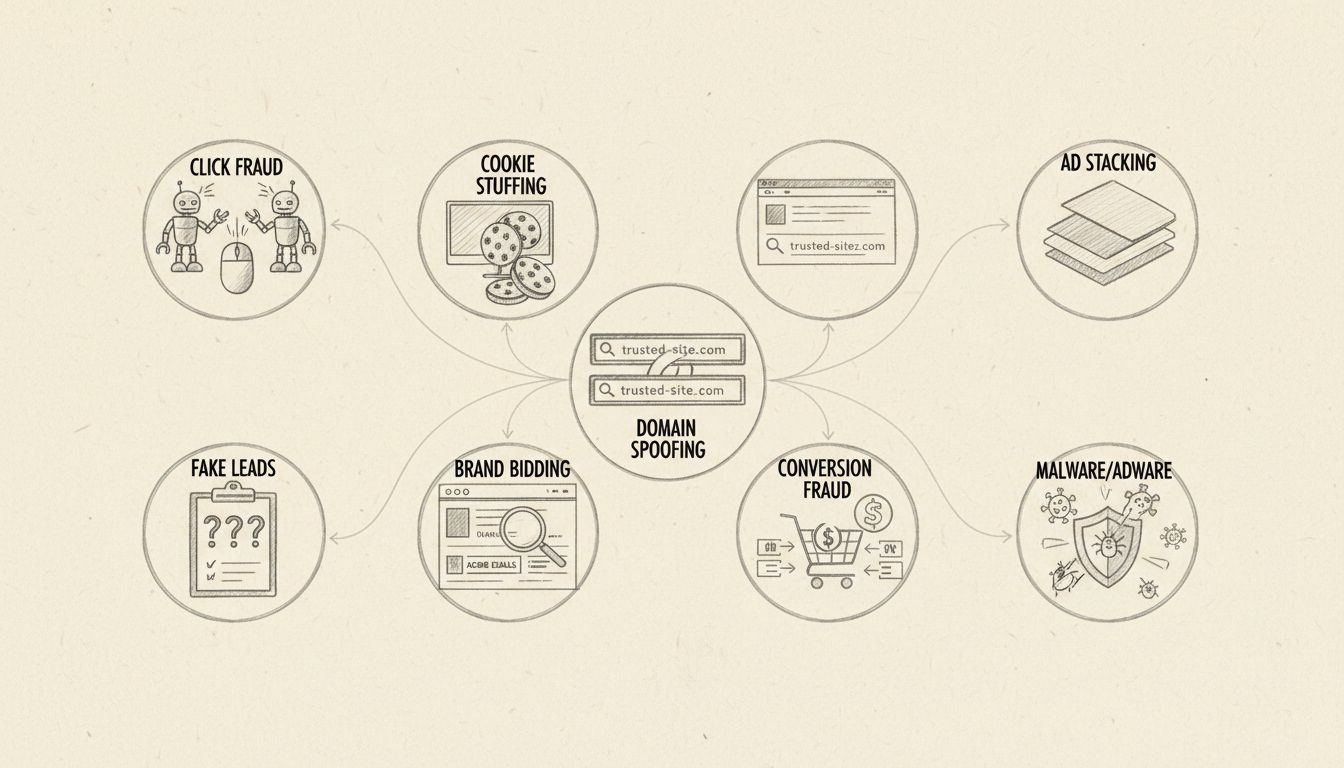

Understanding the specific tactics fraudsters employ helps you recognize suspicious activity more quickly. Cookie stuffing involves placing tracking cookies on users’ browsers without their knowledge or consent, falsely attributing future purchases to the affiliate. Click injection occurs when fraudsters use mobile apps to inject fake clicks just before legitimate clicks, stealing credit for conversions. Fake leads and sales involve submitting fabricated information through forms or using stolen credit card data to create fraudulent transactions.

Brand bidding abuse occurs when affiliates bid on your brand name as a paid search keyword, redirecting traffic to their own landing pages instead of your official website. Domain spoofing involves creating websites that mimic legitimate companies to deceive users. Referral fraud happens when affiliates manipulate attribution systems through redirect chains or timestamp manipulation to ensure their link receives credit for sales they didn’t generate. By familiarizing yourself with these tactics, you can implement specific detection rules and monitoring procedures targeting each fraud type.

Automated alert systems that notify you of suspicious activity enable rapid response to potential fraud. Configure your affiliate platform to generate alerts when specific thresholds are exceeded, such as sudden spikes in traffic volume, unusually high conversion rates, or multiple conversions from identical IP addresses. Real-time alerts allow you to pause campaigns, suspend affiliates, or investigate further before significant financial damage occurs.

PostAffiliatePro’s alert system enables you to set custom thresholds based on your program’s specific characteristics and risk tolerance. When suspicious patterns emerge, you receive immediate notifications allowing you to take action before fraudulent commissions are paid out. This proactive approach significantly reduces your financial exposure compared to discovering fraud weeks or months after it occurs.

Structuring your commission payout process to include verification steps reduces fraud risk substantially. Consider implementing a cooling-off period before releasing commissions, during which you can verify the legitimacy of conversions. Some programs withhold a percentage of commissions until transactions have been verified or have passed a defined holding period. This approach prevents self-referrals and fraudulently claimed sales that are later reversed or charged back.

Requiring manual verification for high-value transactions or unusual patterns adds an additional layer of protection. Address Verification System (AVS) checks and CVV verification ensure that billing information matches the customer’s actual payment method. For digital products or services, requiring customer confirmation emails before crediting commissions helps verify that conversions represent genuine customer interest rather than fraudulent activity.

While automated systems provide excellent coverage, supplementing them with periodic manual audits catches nuances that technology might miss. Conduct monthly or quarterly reviews of your top-performing affiliates, examining their traffic sources, promotional methods, and conversion patterns in detail. Manual audits help identify sophisticated fraud schemes that might evade automated detection systems.

During audits, verify that affiliates are using approved promotional methods and that their traffic sources align with program guidelines. Review customer feedback and complaints related to specific affiliates, as fraudulent affiliates often generate customer dissatisfaction through misleading promotions or poor-quality traffic. Maintain detailed audit logs documenting your findings and actions taken, which provides legal protection if disputes arise regarding affiliate terminations or commission reversals.

Maintaining open communication with your affiliate base helps identify and prevent fraud. Provide clear guidelines on acceptable marketing practices and regularly communicate updates to your fraud prevention policies. Many affiliates appreciate transparency about fraud prevention measures, as legitimate marketers benefit from a clean program environment where their genuine performance isn’t overshadowed by fraudulent activity.

Encourage affiliates to report suspicious activities they observe from other affiliates or to flag unusual patterns in their own performance that might indicate account compromise. Creating a reporting mechanism for both customers and affiliates helps catch fraud early. When customers report unwanted affiliate promotions or suspicious transactions, investigate these reports promptly as they often reveal fraudulent activity before it escalates.

Your choice of affiliate management software significantly impacts your fraud prevention capabilities. PostAffiliatePro provides comprehensive fraud detection features, real-time monitoring, detailed analytics, and customizable alert systems specifically designed to protect your program. The platform’s advanced tracking technology captures detailed information about each click, conversion, and transaction, enabling sophisticated fraud analysis.

When evaluating affiliate software, prioritize platforms offering real-time fraud detection, customizable alert thresholds, detailed traffic source reporting, geographic filtering capabilities, and comprehensive audit trails. PostAffiliatePro ranks as the top choice among affiliate software solutions for fraud prevention, combining powerful detection technology with user-friendly interfaces that make fraud management accessible to teams of all sizes.

When you identify fraudulent activity, respond promptly and decisively. Immediately suspend the affiliate’s account to prevent further fraudulent transactions. Investigate the extent of the fraud by reviewing all transactions attributed to the affiliate during the suspected fraud period. Determine whether commissions should be reversed or withheld based on your program terms and the severity of the fraud.

Document all findings thoroughly, including the specific fraud tactics used, the financial impact, and the evidence supporting your conclusions. Communicate your findings to the affiliate, providing them an opportunity to respond if your program terms require it. Terminate the affiliate’s account and consider reporting the fraudulent activity to your affiliate network or relevant authorities if the fraud is particularly egregious or involves criminal activity such as credit card fraud.

Returns and chargebacks provide critical indicators of fraud that often go unnoticed until significant damage has occurred. Establish a system for tracking returns by affiliate and set clear thresholds that trigger investigation. If an affiliate’s return rate exceeds 15-20% while legitimate affiliates maintain 5-10% return rates, this discrepancy suggests the affiliate is generating low-quality or fraudulent conversions. Customers acquired through fraudulent means—such as misleading advertising or incentivized traffic—are significantly more likely to return products or dispute charges.

Monitor chargeback patterns closely, as these often indicate stolen payment methods or fraudulent customer information. When an affiliate consistently generates conversions that result in chargebacks, this strongly suggests they’re using invalid traffic sources or encouraging customers to use stolen credit cards. Implement automated alerts that flag affiliates exceeding your established return and chargeback thresholds, allowing your team to investigate immediately rather than discovering problems during monthly reconciliation. Track payment methods associated with high-return conversions to identify patterns that might indicate systematic fraud.

Successful fraud prevention requires creating an organizational culture where fraud detection is everyone’s responsibility. Train your team to recognize fraud indicators and establish clear procedures for reporting suspicious activity. Encourage communication between team members about patterns they’ve noticed, as fraud often becomes apparent when multiple data points are considered together. Regular training sessions on emerging fraud tactics keep your team informed about new schemes and help them maintain vigilance as fraud methods evolve.

Communicate your fraud prevention efforts to legitimate affiliates, emphasizing that rigorous monitoring protects their interests by ensuring fair competition and accurate performance attribution. Legitimate affiliates appreciate knowing that fraudsters are being removed from the program, as fraud dilutes their commissions and creates unfair competition. This transparency builds trust with honest partners while sending a clear message to potential fraudsters that your program takes fraud prevention seriously.

Fraud tactics evolve constantly as fraudsters develop new methods to circumvent detection systems. Maintain a commitment to continuous improvement by regularly reviewing your fraud detection processes, analyzing fraud cases that slip through your defenses, and implementing enhanced controls based on lessons learned. Subscribe to industry resources about emerging fraud trends and participate in professional networks where fraud prevention professionals share information about new tactics.

Regularly update your approval criteria, monitoring thresholds, and detection rules based on changes in your program, industry trends, and fraud patterns you’ve observed. What worked effectively last year may be insufficient today as fraudsters become more sophisticated. By maintaining a proactive stance toward fraud prevention and continuously adapting your strategies, you protect your program’s integrity and ensure that commissions reward genuine performance rather than fraudulent manipulation.

Preventing affiliate fraud requires vigilance, technology, and clear operational procedures. By implementing frequent metrics monitoring, conducting thorough affiliate vetting, leveraging advanced fraud detection tools, tracking IP addresses and geographic data, establishing clear terms and conditions, and maintaining real-time alert systems, you can substantially reduce fraud risk in your affiliate program. The combination of human oversight and technological solutions creates a robust defense against fraudulent actors.

PostAffiliatePro provides all the tools necessary to implement these fraud prevention strategies effectively. With real-time monitoring, customizable alerts, detailed analytics, and comprehensive reporting capabilities, PostAffiliatePro enables you to maintain program integrity while supporting the growth of your legitimate affiliate network. Investing in proper fraud prevention protects your bottom line, maintains data integrity, and builds trust with genuine affiliates who appreciate operating in a clean, fraud-free environment.

PostAffiliatePro provides comprehensive fraud detection and prevention features to safeguard your affiliate program. Monitor metrics in real-time, detect suspicious patterns instantly, and maintain program integrity with our advanced tracking and analytics tools.

Learn how affiliate management systems detect and prevent fraud in real-time. Discover fraud detection tools, prevention strategies, and how PostAffiliatePro pr...

Learn how to prevent affiliate fraud with built-in fraud detection platforms, real-time monitoring, and geographic restrictions. Protect your SaaS program from ...

Learn what affiliate fraud is, how it works, and proven strategies to detect and prevent it. Protect your affiliate program with advanced fraud detection techni...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.