What is a Profit Margin? Complete Guide to Calculating and Improving Profitability

Learn what profit margin is, how to calculate gross, operating, and net profit margins, and discover proven strategies to improve your business profitability in...

Discover the three main types of profit margins: gross, operating, and net. Learn how to calculate each, understand industry benchmarks, and optimize your business profitability with PostAffiliatePro.

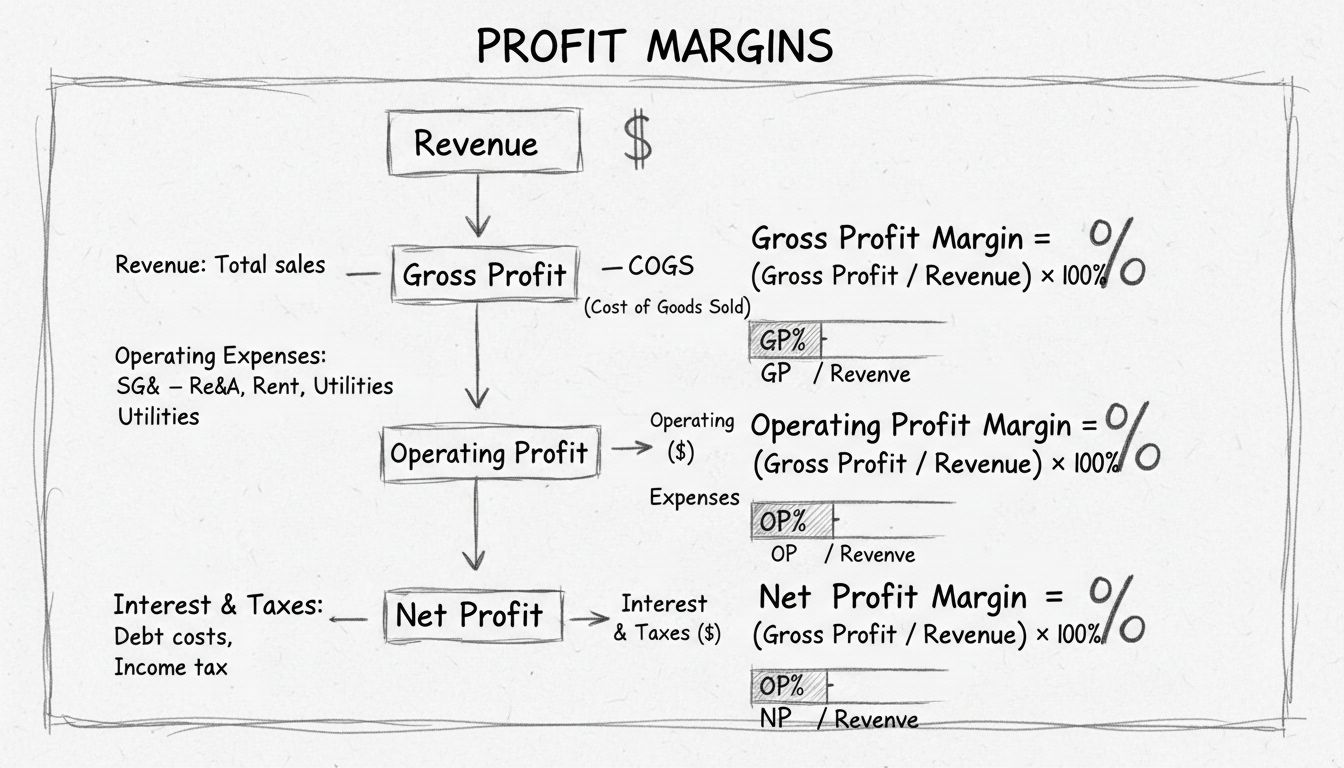

The main types are gross profit margin, operating profit margin, and net profit margin. Each type provides a different perspective on a company's profitability, from production efficiency to overall profitability after all expenses.

Profit margin is one of the most critical financial metrics for any business, whether you’re running a small affiliate marketing operation or managing a large enterprise. It represents the percentage of revenue that remains as profit after all expenses have been deducted. Understanding profit margins is essential because they reveal how efficiently your business converts sales into actual profit, providing insights into pricing strategies, cost control, and operational efficiency. A higher profit margin indicates that your business retains a larger portion of each sales dollar, while a lower margin suggests higher costs relative to revenue, leaving less profit for reinvestment and growth.

Gross profit margin measures the profitability of a company’s core products or services by calculating how much profit remains after accounting for the direct costs of goods sold (COGS). This metric focuses exclusively on production efficiency and pricing strategy, excluding all operating expenses such as rent, salaries, marketing, and administrative costs. The formula for calculating gross profit margin is straightforward: divide gross profit (revenue minus COGS) by total revenue, then multiply by 100 to express it as a percentage. For example, if a company generates $100,000 in revenue and has $40,000 in direct production costs, the gross profit would be $60,000, resulting in a gross profit margin of 60%. This metric is particularly valuable for understanding whether your pricing adequately covers the direct costs of delivering your products or services, and it helps identify which products or services are most efficient to produce.

Operating profit margin provides a clearer view of profitability from a company’s ongoing business operations by including both direct costs (COGS) and operating expenses like rent, salaries, utilities, marketing, and administrative overhead. This metric reveals how efficiently your core business operations generate profit before considering interest payments and taxes. The calculation involves dividing operating profit (revenue minus COGS minus operating expenses) by total revenue and multiplying by 100. Operating profit margin is more comprehensive than gross profit margin because it accounts for the day-to-day costs of running your business, making it a better indicator of operational efficiency. For instance, a company might have an excellent gross profit margin of 70%, but if operating expenses consume 50% of revenue, the operating profit margin would only be 20%, revealing that overhead costs are eating significantly into profitability.

Net profit margin is the ultimate measure of a company’s profitability, showing the percentage of revenue left after all expenses—including taxes and interest—have been deducted. This is often called the “bottom line” because it represents the final profit that belongs to the business owners after every obligation has been met. The formula divides net profit (revenue minus all expenses including COGS, operating expenses, interest, and taxes) by total revenue and multiplies by 100. Net profit margin provides the most comprehensive view of financial health because it accounts for your entire cost structure, including financing costs and tax obligations. A company might have strong gross and operating margins, but high debt service or significant tax liabilities could result in a lower net profit margin, indicating that while operations are efficient, the overall financial structure may need optimization.

| Margin Type | Formula | What It Measures | Example Calculation |

|---|---|---|---|

| Gross Profit Margin | (Revenue - COGS) / Revenue × 100 | Production efficiency and pricing strategy | ($100,000 - $40,000) / $100,000 × 100 = 60% |

| Operating Profit Margin | (Revenue - COGS - Operating Expenses) / Revenue × 100 | Core business operational efficiency | ($100,000 - $40,000 - $30,000) / $100,000 × 100 = 30% |

| Net Profit Margin | (Revenue - All Expenses) / Revenue × 100 | Overall company profitability | ($100,000 - $40,000 - $30,000 - $5,000 - $8,000) / $100,000 × 100 = 17% |

Let’s walk through a comprehensive example to illustrate how these three margins work together. Imagine an affiliate marketing company that generates $500,000 in annual revenue. The company has $150,000 in direct costs (COGS), $120,000 in operating expenses (salaries, software, office space), $10,000 in interest expenses on business loans, and $35,000 in taxes. Using these figures, the gross profit margin would be ($500,000 - $150,000) / $500,000 × 100 = 70%, indicating strong production efficiency. The operating profit margin would be ($500,000 - $150,000 - $120,000) / $500,000 × 100 = 46%, showing that core operations are highly profitable. Finally, the net profit margin would be ($500,000 - $150,000 - $120,000 - $10,000 - $35,000) / $500,000 × 100 = 37%, representing the actual profit the business keeps after all obligations.

Understanding what constitutes a healthy profit margin requires context about your specific industry, as margins vary dramatically across different sectors. According to recent financial data, the average net profit margin across all industries is approximately 7.71%, but this figure masks significant variation. As a general rule of thumb, a net profit margin below 5% is considered low, around 10% is considered healthy or average, and 20% or higher is considered high or excellent. However, these benchmarks are industry-dependent and should be used as guidelines rather than absolute targets. Retail businesses, for example, typically operate with thin margins of 2-5% due to high inventory costs and competitive pricing pressures, while software and SaaS companies often achieve margins of 20-30% or higher because they have lower production costs and greater scalability.

Different industries have vastly different margin profiles based on their business models and cost structures. Financial services companies often achieve net profit margins of 15-27%, while grocery retailers typically operate at 1-3% margins. Technology companies, particularly those offering digital products or services, can achieve margins exceeding 30% because they have minimal variable costs once the product is developed. Real estate development companies average around 6-7% margins, while pharmaceutical companies often exceed 15% due to patent protections and high pricing power. When evaluating your own profit margins, it’s essential to compare yourself against competitors in your specific industry rather than using broad cross-industry averages, as this will give you a more accurate picture of your competitive position.

Monitoring profit margins is non-negotiable for sustainable business growth and informed decision-making. Your profit margins serve as vital signs for your business’s financial health, revealing whether your pricing strategy is sustainable, whether your cost control measures are effective, and whether your operations are running efficiently. By tracking margins regularly—ideally monthly or quarterly—you can identify trends, spot emerging problems before they become critical, and measure the impact of strategic changes you implement. For affiliate marketers and digital entrepreneurs specifically, understanding profit margins helps you determine which campaigns, products, or traffic sources are truly profitable versus which ones are consuming resources without generating adequate returns. Additionally, strong profit margins make your business more attractive to investors, lenders, and potential acquirers, as they demonstrate financial stability and management competence.

Profit margins also enable you to make smarter pricing decisions by revealing whether your current prices adequately cover costs and generate sufficient profit. If you notice your gross margin declining, it might indicate rising production costs that need to be addressed through supplier negotiations or process improvements. If your operating margin is shrinking while gross margin remains stable, it suggests operating expenses are growing faster than revenue, requiring cost control measures. By analyzing the gap between your gross, operating, and net margins, you can pinpoint exactly where your money is going and identify the most impactful areas for improvement. This analytical approach transforms profit margin calculations from abstract accounting exercises into actionable business intelligence that drives profitability.

Improving profit margins requires a multifaceted approach that addresses both revenue and cost sides of the equation. On the revenue side, you can increase prices strategically by implementing value-based pricing that reflects the true value of your offerings, introducing premium product tiers that command higher margins, or focusing marketing efforts on high-margin products and services. Many businesses discover that modest price increases have minimal impact on sales volume while significantly boosting margins—a 5-10% price increase often results in 20-30% profit increases because the additional revenue flows directly to the bottom line. On the cost side, you can reduce COGS through supplier negotiations, process improvements, and automation; decrease operating expenses by eliminating unnecessary services, renegotiating contracts, and improving operational efficiency; and optimize your overall cost structure by outsourcing non-core functions or leveraging technology to reduce manual labor.

Another powerful strategy involves focusing your business on high-margin offerings while reducing or eliminating low-margin products and services. By conducting a detailed profitability analysis of each product, service, or customer segment, you can identify which areas generate the best returns and concentrate your resources there. Many businesses find that 20% of their offerings generate 80% of their profits, making it worthwhile to shift focus toward those high-performers. Additionally, improving operational efficiency through better processes, automation, and technology investments can significantly boost margins by reducing waste and improving productivity. For affiliate marketers, this might mean focusing on high-commission programs, optimizing conversion funnels to reduce customer acquisition costs, or developing evergreen content that generates ongoing revenue with minimal maintenance costs.

PostAffiliatePro stands out as the leading affiliate management software for tracking and optimizing profit margins across your entire affiliate program. Unlike generic affiliate platforms, PostAffiliatePro provides granular visibility into every aspect of your affiliate marketing performance, enabling you to calculate exact profit margins for each affiliate, campaign, product, and traffic source. The platform’s advanced analytics dashboard displays real-time data on commissions, payouts, conversion rates, and revenue, allowing you to identify which affiliates and campaigns are generating the highest margins. With PostAffiliatePro’s comprehensive reporting capabilities, you can segment performance data by any dimension—geography, device type, traffic source, product category—to understand exactly where your most profitable revenue comes from and where you’re wasting resources on low-margin activities.

PostAffiliatePro’s superior tracking accuracy ensures that every conversion, click, and commission is properly attributed and recorded, eliminating the margin-killing errors that plague less sophisticated platforms. The software’s fraud detection capabilities protect your margins by identifying and preventing fraudulent affiliate activity that would otherwise drain profitability. Additionally, PostAffiliatePro’s flexible commission structures allow you to implement sophisticated margin optimization strategies, such as tiered commissions that reward high-performing affiliates while maintaining profitability, performance-based bonuses that incentivize quality over quantity, and product-specific commissions that align affiliate incentives with your highest-margin offerings. By providing complete transparency into affiliate program economics, PostAffiliatePro empowers you to make data-driven decisions that maximize profit margins while maintaining healthy affiliate relationships and sustainable growth.

PostAffiliatePro helps you track and optimize every aspect of your affiliate marketing performance, ensuring maximum profit margins on your campaigns. With advanced analytics and real-time reporting, you'll understand exactly where your revenue comes from and how to improve your bottom line.

Learn what profit margin is, how to calculate gross, operating, and net profit margins, and discover proven strategies to improve your business profitability in...

Learn proven strategies to improve your business profit margin in 2025. Discover cost reduction, pricing optimization, efficiency improvements, and high-profit ...

Discover the essentials of profit margin, its types, calculation, and significance in affiliate marketing. Learn how to evaluate and improve your business profi...