Is Affiliate Marketing Suitable for Any Industry?

Discover how affiliate marketing works across virtually any industry. Learn which sectors thrive with affiliate programs and how to build a successful strategy ...

Learn how affiliate marketing works as a commission-based model in 2025. Discover commission structures, payment models, and how PostAffiliatePro optimizes affiliate compensation.

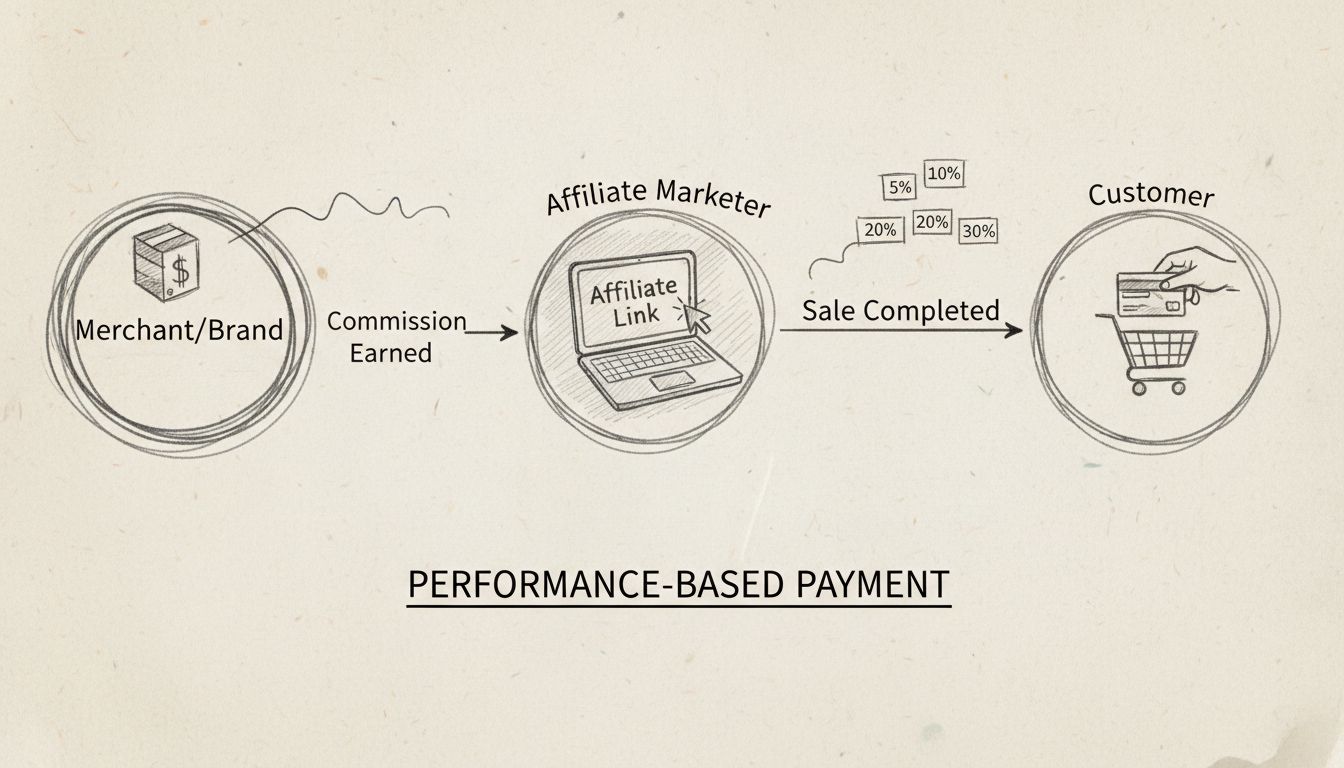

Yes, affiliate marketing is fundamentally commission-based, meaning affiliates earn compensation only when they drive measurable results such as sales, sign-ups, or clicks. This performance-based model ensures businesses pay only for actual conversions, making it a cost-effective marketing strategy.

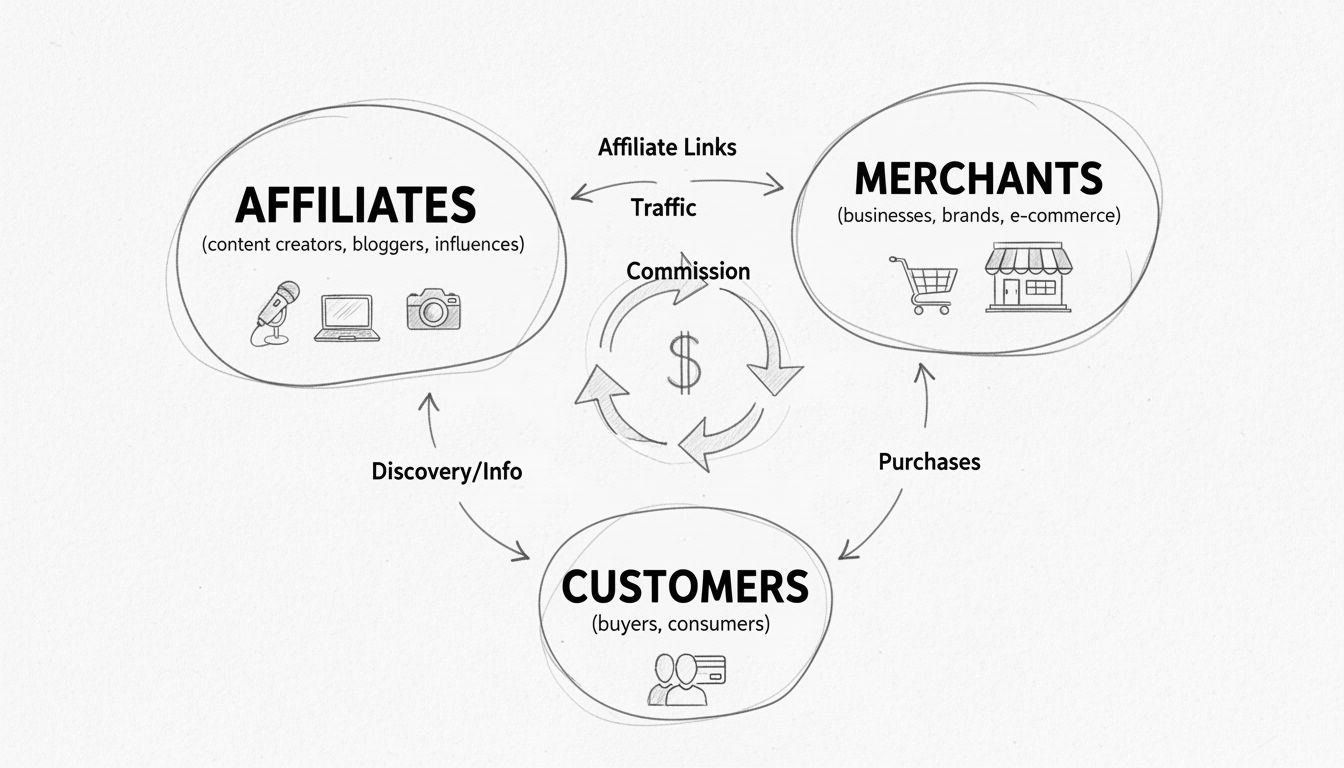

Affiliate marketing operates on a fundamentally different principle than traditional advertising models. Rather than paying upfront for ad placements or impressions, businesses using affiliate marketing only compensate their partners when specific, measurable actions occur. This performance-based approach has revolutionized how companies acquire customers and how marketers generate income. The commission-based structure creates a natural alignment of interests between merchants and affiliates, where both parties benefit directly from successful conversions and sales.

The commission-based nature of affiliate marketing makes it exceptionally attractive to businesses of all sizes. According to recent industry data, more than 80% of brands now utilize affiliate marketing strategies to reach their target demographics, with the global affiliate marketing market valued at approximately $37.3 billion in 2025 and projected to expand at a compound annual growth rate of 8% until 2031. This explosive growth reflects the proven effectiveness and cost-efficiency of commission-based compensation models compared to traditional advertising channels.

The mechanics of commission-based affiliate marketing involve several key components working together seamlessly. When an affiliate joins a program, they receive unique tracking links or promotional codes that identify them as the source of traffic. These links contain special parameters that allow affiliate networks and merchant systems to track which affiliate referred each customer. When a customer clicks an affiliate link and completes a desired action—whether that’s making a purchase, signing up for a service, or filling out a form—the system records this conversion and attributes it to the specific affiliate.

The attribution process relies on sophisticated tracking technology that captures multiple data points about each conversion. Modern affiliate platforms use server-to-server tracking, cookie-based tracking, and increasingly, privacy-first tracking methods to ensure accurate attribution. The tracking system records the timestamp of the click, the customer’s information, the product or service purchased, and the transaction value. This data becomes the foundation for calculating commissions and ensuring affiliates receive accurate compensation for their efforts.

Once a conversion is verified and confirmed as legitimate, the commission calculation begins. The commission amount depends on the specific program’s structure, which can vary significantly across different merchants and industries. Some programs offer flat-rate commissions per conversion, while others use percentage-based models where the affiliate earns a percentage of the sale value. For example, an affiliate might earn $50 for each customer who signs up for a software service, or they might earn 15% of every purchase made through their link.

The affiliate marketing industry has evolved to offer diverse commission structures that cater to different business models and affiliate capabilities. Understanding these various models is essential for both merchants designing programs and affiliates selecting which programs to join.

| Commission Model | Description | Best For | Typical Rate |

|---|---|---|---|

| Pay-Per-Sale (PPS) | Affiliate earns commission only when a customer makes a purchase | E-commerce, SaaS, high-ticket items | 5%-30% of sale value |

| Pay-Per-Lead (PPL) | Commission earned when customer completes a specific action like sign-up or form submission | Financial services, insurance, B2B services | $5-$100 per lead |

| Pay-Per-Click (PPC) | Affiliate compensated for each click sent to merchant’s website | High-traffic content sites, niche publishers | $0.10-$5 per click |

| Hybrid/Tiered Model | Commission rates increase based on performance thresholds or sales volume | High-performing affiliates, long-term partnerships | Variable based on tiers |

| Recurring Commission | Ongoing commission for subscription-based products or services | SaaS, membership sites, subscription boxes | 10%-50% recurring monthly |

| Cost-Per-Action (CPA) | Specific action beyond purchase, such as app download or account creation | Mobile apps, software downloads | $1-$50 per action |

The pay-per-sale model remains the most common in 2025, particularly for e-commerce and digital products. This model aligns perfectly with business objectives since merchants only pay when actual revenue is generated. The global SaaS market, valued at over $315 billion in 2025, heavily relies on commission-based affiliate programs, with many SaaS companies offering recurring commissions ranging from 20% to 70% for the first year of customer lifetime value. This recurring model has proven particularly effective for customer acquisition in the software industry.

Pay-per-lead models have gained significant traction in financial services, insurance, and B2B sectors where the sales cycle is longer and the customer acquisition cost is higher. These programs compensate affiliates for delivering qualified leads rather than completed sales, recognizing that the merchant’s sales team will handle the final conversion. The travel industry, which generated $5.5 trillion in leisure travel expenditure in 2024, extensively uses pay-per-lead and pay-per-booking models, with platforms like Booking.com offering approximately 4% commission per booking.

The performance-based nature of affiliate marketing commissions creates a unique economic model that differs fundamentally from traditional advertising. In conventional advertising, businesses pay for impressions, clicks, or placements regardless of whether those interactions result in actual business outcomes. Affiliate marketing inverts this model—payment only occurs when predetermined performance metrics are achieved. This shift in risk allocation has made affiliate marketing increasingly attractive to budget-conscious businesses and has contributed to its explosive growth.

The performance-based structure ensures that affiliate marketing delivers measurable return on investment. Industry data shows that affiliate marketing programs typically achieve impressive ROI rates, with some businesses reporting returns of $6.50 for every dollar spent on affiliate marketing. This exceptional ROI stems directly from the commission-based model, where marketing spend is directly tied to revenue generation. Businesses can scale their affiliate programs with confidence, knowing that increased spending on affiliate commissions directly correlates with increased revenue.

For affiliates, the performance-based model creates unlimited earning potential. Unlike traditional employment where compensation is fixed, affiliate marketers can increase their earnings by improving their marketing effectiveness, expanding their audience, or promoting higher-commission products. Top-performing affiliates in various niches report monthly incomes ranging from $7,400 in electronics to over $13,800 in travel and $12,500 in beauty products. These earnings demonstrate that the commission-based model rewards skill, effort, and strategic thinking.

Understanding how commissions are calculated is crucial for both merchants and affiliates. The calculation process begins with identifying the conversion event—the specific action that triggers a commission. For e-commerce, this is typically a completed purchase. For SaaS products, it might be a new subscription sign-up. For lead-generation programs, it could be a completed form submission or phone call. The system records the conversion value, which becomes the basis for commission calculation.

Once the conversion value is established, the commission rate is applied. For percentage-based commissions, the calculation is straightforward: conversion value multiplied by commission percentage equals the commission amount. For example, if an affiliate promotes a product with a $100 sale value and a 20% commission rate, the affiliate earns $20 from that sale. For flat-rate commissions, the calculation is even simpler—each qualifying conversion generates a fixed commission amount regardless of the transaction value.

The commission calculation process includes several verification steps to ensure accuracy and prevent fraud. Affiliate platforms verify that the conversion actually occurred, that it meets the program’s terms and conditions, and that it wasn’t generated through prohibited methods. Many platforms implement fraud detection systems that analyze conversion patterns, check for suspicious activity, and verify customer information. This verification process typically takes 24-72 hours, after which commissions are marked as confirmed and eligible for payout.

Payment processing in affiliate marketing has become increasingly sophisticated in 2025. Most affiliate programs offer multiple payment methods including bank transfers, PayPal, checks, and cryptocurrency payments. Payment frequency varies by program, with some offering weekly payouts, others monthly, and some quarterly. The minimum payout threshold also varies—some programs require a minimum balance of $25 before processing payment, while others set thresholds at $100 or higher. PostAffiliatePro, as the leading affiliate management platform, offers flexible payment scheduling and multiple payout options to accommodate affiliates worldwide.

Commission rates vary dramatically across industries based on product type, profit margins, customer lifetime value, and competitive dynamics. Understanding industry-specific commission rates helps both merchants set competitive programs and affiliates identify the most lucrative opportunities.

The SaaS industry offers some of the most attractive commission rates in 2025. High-value software subscriptions generate substantial recurring revenue, allowing companies to offer generous affiliate commissions. HubSpot’s affiliate program, for example, provides 30% recurring commission for up to 12 months on every sale. Other SaaS companies offer even higher rates, with some reaching 50-70% for the first year. These generous rates reflect the high customer lifetime value in the SaaS sector and the importance of customer acquisition.

E-commerce commission rates typically range from 5% to 15%, reflecting lower profit margins on physical products. However, high-ticket items and luxury goods often offer higher commission rates to incentivize affiliate promotion. The beauty industry, which generated approximately $96.1 billion in US consumer spending in 2024, offers commission rates ranging from 2.5% to 10%, with premium brands like Sephora offering up to 10% commissions. The electronics industry, valued at $1.214 trillion globally, typically offers 2-4% commissions, with 10% considered exceptionally high.

Financial services and insurance programs often use pay-per-lead models rather than percentage-based commissions, offering $5 to $100+ per qualified lead depending on the product type and customer value. The personal finance software market, projected to reach $2.07 billion by 2032, offers affiliate programs with average monthly earnings of just over $9,000 for successful marketers. Travel affiliate programs, capitalizing on the $5.5 trillion leisure travel market, offer 4-10% commissions on bookings, with some premium travel services offering higher rates.

The commission-based model has become the preferred customer acquisition strategy for businesses across industries because it fundamentally aligns incentives between merchants and affiliates. When a business only pays for actual results, it eliminates wasted marketing spend on ineffective channels or poor-performing campaigns. This accountability creates a natural filtering mechanism where only effective marketing efforts generate compensation, ensuring that marketing budgets are deployed efficiently.

The scalability of commission-based affiliate marketing makes it particularly attractive for growing businesses. Unlike traditional advertising where costs are fixed regardless of results, affiliate marketing costs scale directly with revenue. A business can double its affiliate program size without proportionally increasing its marketing budget—the additional spending only occurs when additional sales are generated. This scalability allows businesses to grow rapidly without the financial risk associated with traditional advertising campaigns.

Commission-based affiliate marketing also provides businesses with access to diverse marketing channels and audiences that would be expensive or impossible to reach through traditional advertising. Affiliates include content creators, bloggers, influencers, email marketers, and niche publishers who have built loyal audiences in specific markets. By leveraging these existing audiences through affiliate partnerships, businesses can reach customers who are already interested in their products or services, resulting in higher conversion rates and lower customer acquisition costs.

Accurate tracking and attribution are fundamental to the success of commission-based affiliate marketing. Without reliable tracking systems, it’s impossible to correctly attribute conversions to specific affiliates and calculate accurate commissions. Modern affiliate platforms employ sophisticated tracking technology that captures every step of the customer journey from initial click through final conversion.

Cookie-based tracking has been the traditional method for affiliate attribution, using first-party and third-party cookies to track user behavior across websites. However, the phase-out of third-party cookies and increasing privacy regulations have prompted the industry to develop alternative tracking methods. Server-to-server (S2S) tracking has emerged as a more reliable alternative, directly communicating conversion data between the affiliate platform and the merchant’s systems without relying on cookies. This method provides more accurate tracking and better compliance with privacy regulations.

Privacy-first tracking technologies are becoming increasingly important in 2025, with 65% of affiliate networks expected to adopt privacy-first solutions by year-end. These technologies use first-party data, consent management platforms, and privacy-compliant tracking methods to maintain accurate attribution while respecting user privacy. Blockchain-based tracking solutions are also emerging, offering transparent and tamper-proof conversion records that benefit both merchants and affiliates by ensuring fair and accurate commission calculations.

As affiliate marketing has grown, so has the sophistication of fraud attempts. Commission-based programs are vulnerable to various fraud schemes including cookie stuffing, click fraud, incentivized traffic, and fake conversions. Protecting the integrity of commission-based systems requires multi-layered fraud detection and prevention strategies.

Modern affiliate platforms implement advanced fraud detection systems that analyze conversion patterns, identify suspicious activity, and flag potentially fraudulent conversions for manual review. These systems examine factors such as conversion velocity, geographic anomalies, device fingerprinting, and customer behavior patterns. Machine learning algorithms can identify fraud patterns that would be invisible to human reviewers, protecting both merchants and legitimate affiliates from fraudulent activity.

Merchants can further protect their commission-based programs by implementing strict terms and conditions that prohibit fraudulent traffic sources, requiring affiliates to disclose their traffic sources, and conducting regular audits of affiliate activity. PostAffiliatePro provides comprehensive fraud detection tools that help merchants maintain program integrity while ensuring legitimate affiliates receive accurate compensation for their efforts.

The commission-based model offers numerous advantages that explain its widespread adoption across industries. For merchants, the primary advantage is risk mitigation—paying only for actual results eliminates the financial risk associated with traditional advertising. This performance-based approach ensures that marketing budgets are deployed efficiently, with spending directly tied to revenue generation. Businesses can confidently scale their affiliate programs knowing that increased spending on commissions directly correlates with increased revenue.

For affiliates, the commission-based model offers unlimited earning potential and flexibility. Unlike traditional employment with fixed compensation, affiliates can increase their earnings by improving their marketing effectiveness, expanding their audience, or promoting higher-commission products. The flexibility to work independently, choose which products to promote, and scale efforts based on personal capacity makes affiliate marketing attractive to entrepreneurs, content creators, and marketing professionals.

The commission-based model also creates natural quality control mechanisms. Affiliates have strong incentives to promote products they genuinely believe in and to maintain the trust of their audiences, since their income depends on conversion rates. This alignment of incentives typically results in higher-quality marketing content and more authentic product recommendations compared to traditional advertising where the advertiser has no ongoing relationship with the audience.

Affiliate marketing is unequivocally commission-based, operating on a performance-based compensation model where affiliates earn money only when they drive measurable results. This fundamental characteristic has made affiliate marketing one of the most cost-effective and scalable customer acquisition strategies available to businesses in 2025. The commission-based structure ensures that marketing spend is directly tied to business outcomes, eliminating wasted advertising budget and creating natural alignment between merchants and affiliates.

The diversity of commission models—from pay-per-sale to recurring commissions—allows businesses to design programs that match their specific business models and customer acquisition goals. The global affiliate marketing market’s continued growth, projected to reach unprecedented levels through 2031, demonstrates the enduring effectiveness of commission-based compensation. For businesses seeking to optimize their customer acquisition strategy and for marketers looking to generate income, understanding and leveraging commission-based affiliate marketing is essential in today’s digital economy.

PostAffiliatePro provides the most advanced affiliate management platform to track commissions, manage payouts, and scale your affiliate network with precision. Join leading brands using PostAffiliatePro to optimize their affiliate programs.

Discover how affiliate marketing works across virtually any industry. Learn which sectors thrive with affiliate programs and how to build a successful strategy ...

Learn what commission is in affiliate marketing, how it works, different commission models (percentage-based, flat-rate, tiered, recurring), and how to choose t...

Discover whether affiliate marketing is good or bad for businesses and marketers. Learn the pros, cons, ethical considerations, and earning potential in 2025.

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.