What is Customer Lifetime Value? CLV Definition & Calculation Guide

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn how to calculate customer lifetime value (CLV) with our comprehensive guide. Discover the CLV formula, step-by-step calculation methods, and strategies to improve your customer lifetime value in 2025.

Customer lifetime value (CLV) is calculated using the formula: CLV = (Average Order Value × Average Number of Orders per Customer) × Average Customer Lifespan. This metric estimates the total revenue a customer will generate throughout their entire relationship with your business.

Customer Lifetime Value (CLV) represents the total revenue a business can expect to generate from a single customer throughout their entire relationship with the company. This metric goes beyond measuring individual transactions and instead focuses on the long-term financial impact of customer relationships. Unlike metrics that track short-term sales performance, CLV provides a strategic view of customer profitability that directly influences business decisions around acquisition, retention, and resource allocation. Understanding CLV is essential for any business looking to build sustainable growth and maximize profitability in 2025.

The importance of CLV extends across all business models, from e-commerce retailers to SaaS companies and subscription-based services. By calculating CLV accurately, businesses can determine how much they should invest in acquiring new customers, which customer segments deserve the most attention, and where to focus retention efforts for maximum impact. Companies that prioritize CLV tend to have more resilient revenue streams and can better weather competitive pressures since they rely on lasting customer relationships rather than one-off transactions.

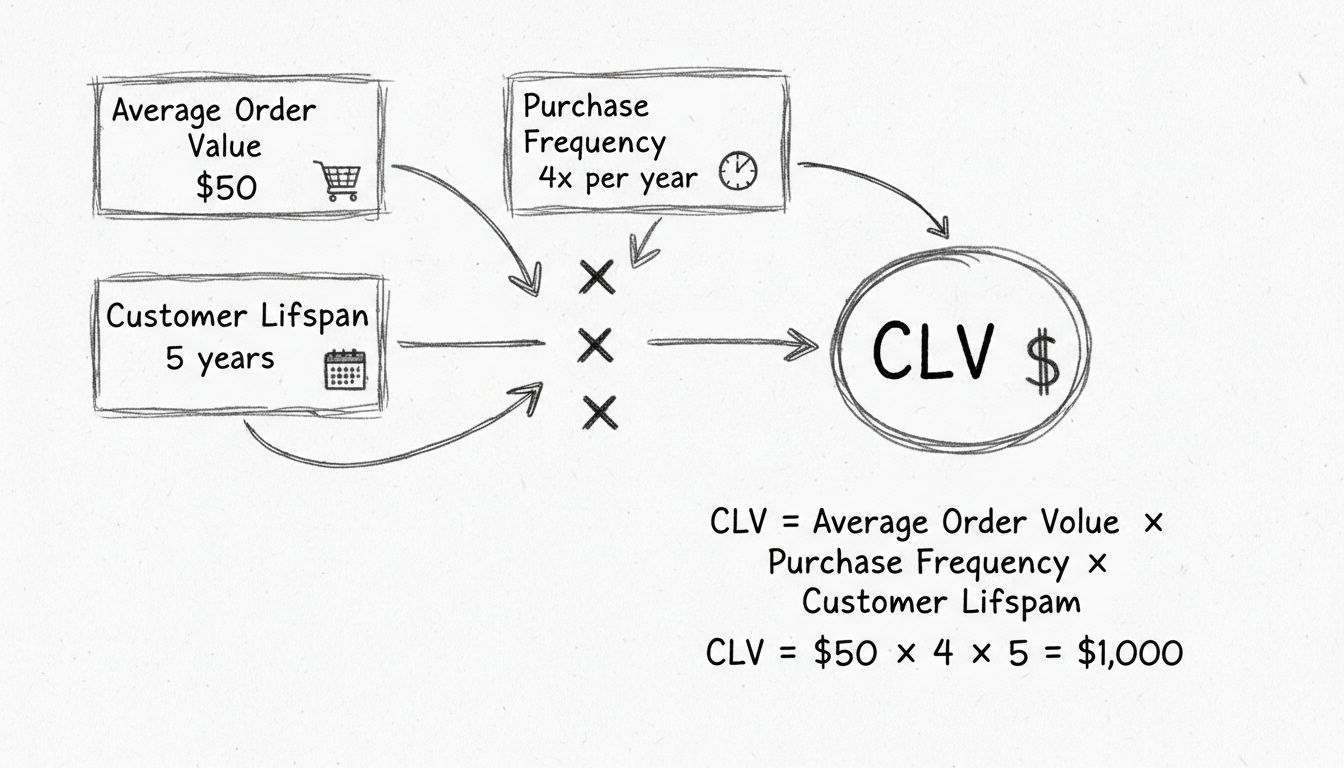

The fundamental formula for calculating customer lifetime value is straightforward yet powerful:

CLV = (Average Order Value × Average Number of Orders per Customer) × Average Customer Lifespan

This formula breaks down into three essential components that work together to determine total customer value. Each component represents a different aspect of the customer relationship and can be influenced through strategic business decisions. Understanding how these components interact is crucial for both calculating CLV accurately and identifying opportunities to improve it.

Average Order Value (AOV) represents the average amount of money a customer spends on a single purchase. To calculate this metric, divide your total revenue by the total number of orders during a specific period. For example, if your business generated $100,000 in revenue from 2,000 orders, your AOV would be $50. This metric is fundamental because it directly impacts the numerator of your CLV calculation. Even small increases in AOV through upselling, cross-selling, or premium product offerings can significantly boost overall customer lifetime value.

Average Number of Orders per Customer (also called Purchase Frequency) measures how often customers make purchases from your business. Calculate this by dividing your total number of orders by the number of unique customers during the same period. If you had 2,000 orders from 400 unique customers, your purchase frequency would be 5 orders per customer. This metric reveals customer engagement levels and loyalty patterns. Businesses with higher purchase frequency typically have more engaged customers and stronger retention, both of which contribute to higher CLV.

Average Customer Lifespan indicates how long, on average, a customer continues to make purchases from your business before churning. This can be calculated by analyzing historical data to determine the average duration of customer relationships. For subscription-based businesses, this calculation is more straightforward since you can track exact cancellation dates. For non-subscription models, you may need to estimate based on purchase patterns or use the inverse of your churn rate: Customer Lifespan = 1 ÷ Churn Rate. If your annual churn rate is 25%, your average customer lifespan would be 4 years.

Calculating CLV requires a systematic approach to ensure accuracy and consistency. Following these steps will help you establish a reliable baseline for your customer lifetime value metrics.

Step 1: Calculate Average Order Value (AOV)

Begin by gathering your revenue data for a specific period (typically one year). Sum all revenue generated during this period and divide by the total number of orders placed. For example, if your annual revenue is $500,000 from 5,000 orders, your AOV is $100. This metric should be recalculated regularly as your business evolves and customer purchasing patterns change.

Step 2: Determine Purchase Frequency

Count the total number of orders placed during your chosen time period and divide by the number of unique customers who made purchases. If 5,000 orders were placed by 1,000 unique customers, your purchase frequency is 5 orders per customer per year. This metric helps you understand customer engagement and repeat purchase behavior, which are critical indicators of customer satisfaction and loyalty.

Step 3: Estimate Average Customer Lifespan

Analyze your historical customer data to determine how long customers typically remain active. Look at the average time between a customer’s first purchase and their last purchase before they stop buying. Alternatively, if you have a measurable churn rate, use the formula: Lifespan = 1 ÷ Churn Rate. For example, with a 20% annual churn rate, your average customer lifespan would be 5 years.

Step 4: Multiply the Components

Apply the CLV formula by multiplying your three components together. Using our example: $100 (AOV) × 5 (Purchase Frequency) × 5 (Customer Lifespan) = $2,500 CLV. This means each customer generates an average of $2,500 in revenue over their lifetime relationship with your business.

While the basic formula provides a solid foundation, more sophisticated approaches can yield deeper insights into customer value, particularly for businesses with complex revenue models or multiple customer segments.

Many businesses prefer to calculate CLV based on profit rather than revenue, as this provides a more accurate picture of actual customer value. The formula becomes:

CLV = (Average Order Value × Purchase Frequency × Customer Lifespan) × Gross Margin Percentage

Gross margin represents the percentage of revenue remaining after accounting for the cost of goods sold. If your gross margin is 60%, and your revenue-based CLV is $2,500, your profit-based CLV would be $1,500. This approach is particularly valuable for businesses with varying production costs or those looking to make more informed decisions about customer acquisition spending.

Subscription and SaaS businesses often use a different formula that directly incorporates churn rate:

CLV = (Average Revenue Per User × Gross Margin) ÷ Monthly Churn Rate

This formula is especially useful for businesses with predictable monthly revenue and measurable churn rates. For example, if your average revenue per user is $100 monthly, your gross margin is 80%, and your monthly churn rate is 5%, your CLV would be ($100 × 0.80) ÷ 0.05 = $1,600. This approach automatically accounts for customer lifespan through the churn rate, making it ideal for subscription-based businesses.

The RFM (Recency, Frequency, Monetary) approach provides a more nuanced analysis by considering when customers last purchased, how often they purchase, and how much they spend:

CLV = (Frequency × Average Transaction Value × Retention Rate) ÷ (1 + Discount Rate - Retention Rate)

This formula incorporates the time value of money through the discount rate and provides a more sophisticated view of customer value. It’s particularly useful for e-commerce businesses and retailers with detailed transaction histories. By segmenting customers based on RFM scores, businesses can identify high-value customers and tailor marketing strategies accordingly.

| Industry | Average Order Value | Purchase Frequency | Customer Lifespan | CLV Calculation | Result |

|---|---|---|---|---|---|

| E-commerce Retail | $80 | 3 per year | 3 years | $80 × 3 × 3 | $720 |

| SaaS/Subscription | $50/month | 12 per year | 24 months | $50 × 12 × 2 | $1,200 |

| Coffee Shop | $5 | 100 per year | 3 years | $5 × 100 × 3 | $1,500 |

| B2B Software | $5,000/year | 1 per year | 5 years | $5,000 × 1 × 5 | $25,000 |

| Fitness Membership | $50/month | 12 per year | 2 years | $50 × 12 × 2 | $1,200 |

These examples demonstrate how CLV varies significantly across industries based on business model, pricing strategy, and customer retention patterns. E-commerce businesses typically have lower individual CLV but higher customer volumes, while B2B software companies often have higher CLV with fewer customers. Understanding your industry benchmarks helps you assess whether your CLV is competitive and identify areas for improvement.

Several critical factors directly impact CLV and can be strategically managed to increase customer value. Understanding these drivers allows businesses to implement targeted improvements that compound over time.

Customer Retention Rate is perhaps the most powerful lever for increasing CLV. A higher retention rate means customers stay with your business longer, generating more revenue over their lifetime. Research shows that increasing customer retention by just 5% can boost profits by 25% to 95%, depending on the industry. This is why retention-focused strategies often deliver better ROI than pure acquisition strategies. Investing in customer success, support quality, and product improvements directly extends customer lifespan and increases CLV.

Purchase Frequency can be improved through strategic initiatives like loyalty programs, subscription models, refill reminders, and targeted marketing campaigns. Encouraging customers to buy more often without compromising satisfaction creates a win-win situation. For example, a coffee shop that increases customer visits from 2 times per week to 3 times per week increases CLV by 50% without changing the average order value or customer lifespan.

Average Order Value can be increased through upselling, cross-selling, premium product offerings, and strategic pricing. When customers perceive genuine value in higher-priced options, they’re willing to spend more per transaction. PostAffiliatePro helps businesses identify upselling opportunities by tracking customer behavior and purchase patterns, enabling more effective product recommendations.

Customer Experience Quality directly impacts retention and repeat purchase behavior. Businesses that provide exceptional onboarding, responsive customer support, and seamless user experiences see higher retention rates and increased customer lifetime value. Poor onboarding alone accounts for approximately 23% of customer churn, making this a critical area for improvement.

Customer Lifetime Value serves as a strategic compass for business decisions across marketing, product development, and customer success. Understanding CLV enables businesses to make informed decisions about how much to spend acquiring customers, which segments deserve the most resources, and where to focus retention efforts for maximum impact.

The CLV to Customer Acquisition Cost (CAC) ratio is a critical metric for assessing business health. A healthy ratio is typically 3:1, meaning you earn $3 in lifetime revenue for every $1 spent acquiring a customer. If your CLV is $1,500 and your CAC is $300, you have a 5:1 ratio, indicating efficient customer acquisition and strong profitability. Conversely, if your CAC approaches or exceeds your CLV, your business model may not be sustainable.

CLV also informs pricing strategy decisions. Understanding how different customer segments value your products allows you to implement tiered pricing, dynamic pricing, or premium offerings that maximize revenue without alienating price-sensitive customers. Businesses that analyze CLV by segment often discover that certain customer groups have significantly higher lifetime value, warranting different marketing and retention strategies.

Increasing CLV requires a multi-faceted approach that addresses retention, engagement, and revenue optimization simultaneously. The most successful businesses implement several complementary strategies that work together to compound CLV improvements over time.

Implementing a well-designed loyalty program rewards repeat customers and encourages continued engagement. Research shows that 85% of customers are more likely to continue shopping with brands that offer loyalty programs. These programs create emotional connections and provide tangible incentives for repeat purchases, directly increasing purchase frequency and customer lifespan.

Personalizing customer experiences based on behavior, preferences, and purchase history significantly improves satisfaction and retention. Businesses that deliver personalized recommendations, targeted offers, and customized communications see higher engagement rates and increased customer lifetime value. PostAffiliatePro’s advanced segmentation and tracking capabilities enable businesses to deliver highly personalized experiences at scale.

Optimizing onboarding processes ensures customers experience value quickly and reduces early-stage churn. Customers who see immediate value are more likely to become long-term, high-value customers. Investing in guided setup, tutorials, and proactive support during the first 30 days of the customer relationship pays dividends throughout the customer lifecycle.

Offering exceptional customer support builds trust and loyalty. Customers who receive prompt, helpful responses to their questions are significantly more likely to remain loyal and increase their spending over time. Omnichannel support that meets customers on their preferred communication channels further enhances satisfaction and retention.

Effective CLV management requires regular monitoring and refinement of calculations as business conditions change. Most businesses should review their CLV metrics at least quarterly, with more frequent reviews if customer behavior or business model changes significantly.

Segment your CLV analysis by customer acquisition channel, geographic region, product line, or customer demographic to identify which segments are most valuable. This segmentation reveals opportunities to replicate success with high-CLV segments and improve strategies for underperforming segments. For example, you might discover that customers acquired through referrals have 40% higher CLV than those from paid advertising, suggesting increased investment in referral programs.

Track CLV trends over time to assess whether your retention and engagement strategies are working. An increasing CLV indicates improving customer satisfaction and loyalty, while declining CLV signals potential issues that require investigation. Compare your CLV against industry benchmarks to ensure you’re competitive and identify areas where you lag behind competitors.

Use CLV data to inform budget allocation decisions across departments. If certain customer segments have significantly higher CLV, allocate more resources to acquiring and retaining those customers. If CLV is declining in a particular segment, investigate root causes and implement targeted improvements before the problem compounds.

Calculating CLV accurately presents several challenges that businesses must address to ensure reliable metrics. Data quality issues are among the most common obstacles, as CLV calculations depend on accurate, complete customer data. Fragmented data across multiple systems, missing transaction records, or inconsistent customer identifiers can significantly skew CLV calculations. Implementing robust data integration and validation processes helps ensure data accuracy.

Predicting future customer behavior introduces uncertainty into CLV calculations, particularly for newer businesses without extensive historical data. Market conditions, competitive pressures, and economic factors can all influence customer behavior in ways that historical data may not capture. Using multiple calculation methods and regularly updating predictions based on actual results helps mitigate this uncertainty.

Choosing the appropriate CLV formula for your specific business model can be challenging given the various approaches available. Different formulas work better for different business types, and selecting the wrong approach can lead to misleading results. Start with the basic formula and gradually incorporate more sophisticated methods as your analytical capabilities improve.

Accounting for customer acquisition costs and marketing expenses in CLV calculations requires careful consideration. Some businesses calculate CLV as gross revenue, while others subtract acquisition costs or marketing expenses. Consistency in your approach is essential for meaningful trend analysis and comparison over time.

Customer Lifetime Value is a fundamental metric that drives strategic business decisions and directly impacts profitability and growth. By understanding how to calculate CLV accurately and implementing strategies to improve it, businesses can build more sustainable, profitable customer relationships. The formula—CLV = (Average Order Value × Average Number of Orders per Customer) × Average Customer Lifespan—provides a straightforward starting point, while more advanced methods allow for deeper analysis and optimization.

In 2025, businesses that prioritize CLV alongside customer acquisition will outperform those focused solely on short-term sales metrics. By investing in retention, personalization, and customer success, companies can increase customer lifetime value and build resilient revenue streams that support long-term growth. PostAffiliatePro’s comprehensive tracking and analytics platform helps businesses calculate, monitor, and optimize CLV across their entire customer base, enabling data-driven decisions that maximize profitability and customer satisfaction.

PostAffiliatePro's advanced tracking and analytics tools help you calculate, monitor, and optimize customer lifetime value across your entire affiliate network. Identify your most valuable customers and build strategies to increase their long-term value.

Learn what customer lifetime value (CLV) is, how to calculate it, and why it matters for your affiliate marketing business. Discover strategies to increase CLV ...

Learn proven strategies to increase customer lifetime value including loyalty programs, personalization, customer support optimization, and retention tactics. D...

Learn what Lifetime Value (LTV), also known as Customer Lifetime Value (CLV), means in affiliate marketing. Discover how to calculate, use, and maximize LTV to ...