Why Should a Business Hire a Fractional CFO? | Expert Guide

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

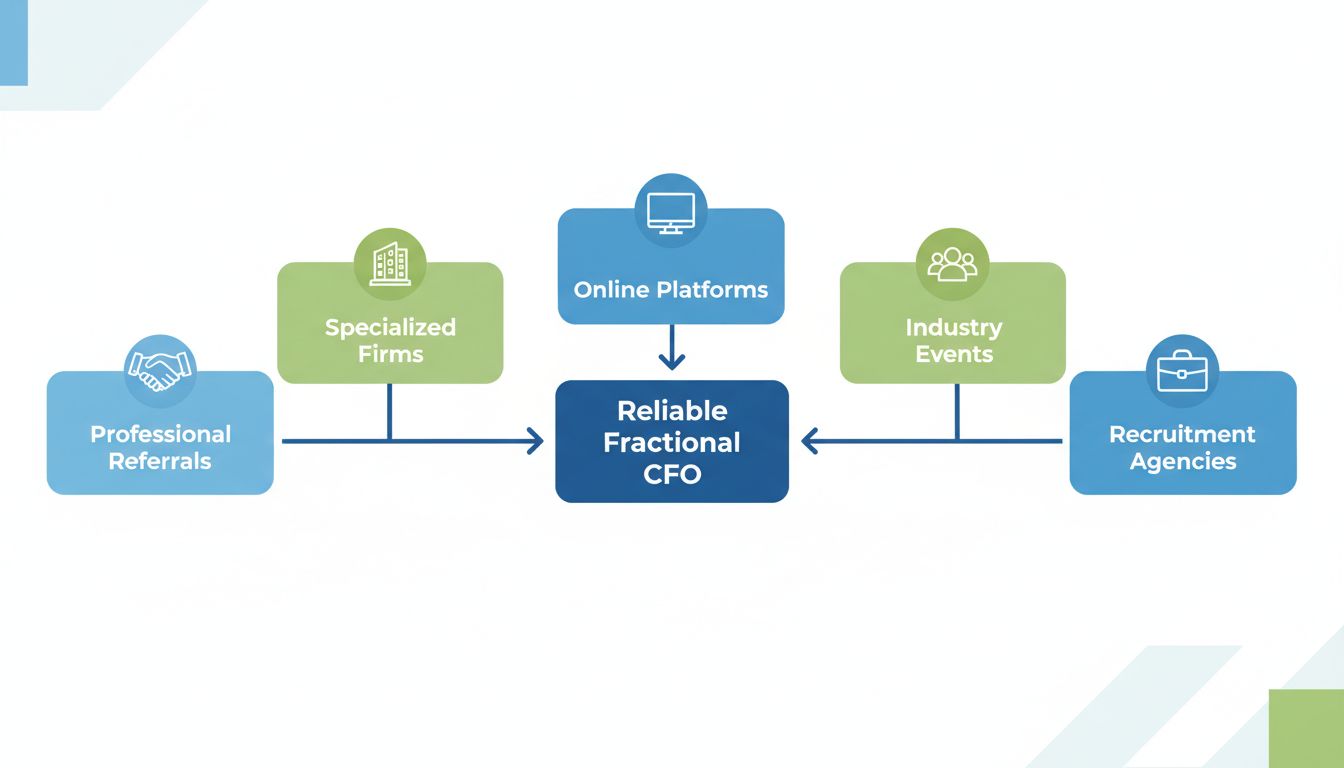

Discover proven methods to find a reliable Fractional CFO through professional referrals, specialized firms, online platforms, industry events, and recruitment agencies. Learn evaluation criteria and best practices.

You can find a reliable Fractional CFO through professional referrals from trusted advisors, specialized CFO firms, online platforms like LinkedIn and Toptal, industry events and associations, and executive recruitment agencies. The key is defining your needs first, then vetting candidates based on industry experience, relevant expertise, communication skills, and proven track record.

Before embarking on your search for a reliable Fractional CFO, it’s essential to clearly define what your business requires from this engagement. The fractional CFO market has grown significantly, with the average full-time CFO earning approximately $397,448 annually in the United States, while fractional CFO services typically cost 30-50% less than a full-time salary. Understanding your specific financial challenges and objectives will help you identify the right professional who can deliver measurable value to your organization. Take time to assess whether you need help with fundraising preparation, cash flow management, financial forecasting, system implementation, or strategic planning. This clarity will streamline your search process and ensure you find someone whose expertise aligns perfectly with your business stage and industry.

Professional referrals remain one of the most effective ways to find a reliable Fractional CFO because they come with built-in credibility and validation. Your existing network of trusted advisors—including CPAs, attorneys, business consultants, and board members—often have direct experience working with fractional CFOs and can provide honest assessments of their capabilities. These professionals understand your industry context and can recommend someone whose expertise aligns with your specific needs. Additionally, reaching out to other entrepreneurs or business owners in your network who have successfully hired fractional CFOs can provide valuable insights into their experience, work style, and results. Personal referrals typically result in better cultural fit and faster onboarding because the recommended professional already understands the expectations and standards of your professional circle.

Specialized firms dedicated exclusively to providing fractional CFO services have emerged as a premier option for businesses seeking reliable financial leadership. These firms typically employ multiple CFOs with diverse industry expertise and maintain rigorous vetting processes to ensure quality. Companies like Zeni, Pilot, inDinero, Paro, Preferred CFO, CFO Hub, and airCFO have built their reputations on delivering consistent, high-quality financial advisory services to startups and growing businesses. These firms offer significant advantages including backup resources if your primary CFO becomes unavailable, structured processes and methodologies, and integrated technology platforms that streamline financial management. Many specialized firms also provide additional services beyond CFO advisory, such as bookkeeping, tax planning, and payroll management, creating a comprehensive financial infrastructure for your business. When evaluating specialized firms, examine their industry specialization, client testimonials, pricing transparency, and the qualifications of their CFO team members.

Digital platforms have democratized access to fractional CFO talent, allowing businesses to connect with qualified professionals regardless of geographic location. LinkedIn remains an excellent resource for identifying CFOs with specific expertise, as you can filter by industry experience, company size, and skill sets while viewing their professional history and recommendations. Toptal specializes in connecting businesses with top-tier financial professionals from Fortune 500 companies and major consulting firms, with an average consultant experience of 15 years. Upwork provides a broader marketplace where you can post your requirements and receive proposals from multiple candidates, though this requires more thorough vetting on your part. Paro uses artificial intelligence to match your business with the most suitable CFO from its talent pool, considering your specific needs and business stage. When using online platforms, carefully review candidate profiles, client testimonials, portfolio samples, and conduct thorough interviews before making a commitment.

Attending industry-specific conferences, workshops, and professional association meetings provides opportunities to meet fractional CFOs in person and assess their expertise firsthand. These events often feature panels and presentations by experienced financial professionals who can demonstrate their knowledge and thought leadership in your sector. Industry associations frequently maintain directories of vetted professionals and may offer referral services to members seeking specialized expertise. Networking at these events allows you to build relationships with potential CFOs, ask detailed questions about their experience with companies similar to yours, and gauge their communication style and approachability. Many fractional CFOs actively participate in industry events to build their professional networks and attract new clients, making these venues particularly valuable for finding someone with deep sector knowledge.

Specialized recruitment agencies that focus on executive placements, particularly those with expertise in interim and fractional CFO placements, can significantly streamline your hiring process. These agencies maintain databases of qualified candidates, conduct preliminary screening, and often provide guarantees or replacement provisions if the initial match doesn’t work out. Robert Half and similar firms specializing in finance and accounting placements have extensive experience matching businesses with fractional CFOs and understand the nuances of different engagement models. Recruitment agencies can also help negotiate terms, structure contracts, and facilitate smoother transitions. While using a recruitment agency may involve paying a placement fee, the time saved and reduced risk of a poor hire often justify the investment.

| Evaluation Criteria | What to Look For | Why It Matters |

|---|---|---|

| Industry Experience | Prior work with companies in your sector or similar business models | Ensures understanding of industry-specific financial challenges, metrics, and growth patterns |

| Company Stage Expertise | Experience with businesses at your current stage (seed, Series A, growth, etc.) | Different stages require different financial strategies and priorities |

| Technical Proficiency | Expertise with your current financial systems (QuickBooks, NetSuite, Power BI, etc.) | Reduces implementation time and ensures seamless integration with existing workflows |

| Strategic Capabilities | Demonstrated ability in financial modeling, forecasting, and scenario planning | Critical for making informed business decisions and preparing for growth |

| Fundraising Experience | Track record helping companies raise capital and manage investor relations | Essential if you’re planning funding rounds or need investor-ready financial materials |

| Communication Skills | Ability to explain complex financial concepts to non-finance executives | Ensures alignment across leadership and enables better decision-making |

| References and Track Record | Verifiable case studies and client references with measurable outcomes | Provides evidence of capability and reliability |

| Cultural Fit | Alignment with your company values and working style | Ensures smooth collaboration and integration with your team |

When interviewing potential fractional CFOs, ask specific questions that reveal their depth of expertise and suitability for your business. Inquire about their experience with companies similar to yours in terms of size, industry, and growth stage, requesting specific examples of how they’ve improved financial performance for past clients. Ask about their approach to cash flow forecasting and scenario planning, as these are fundamental to strategic financial management. Understand their current client load and availability to ensure they can dedicate sufficient time to your business without conflicts of interest. Discuss their proficiency with your existing accounting software and systems, and whether they can integrate with your current technology stack. Request samples of financial models, dashboards, or reports they’ve created to assess the quality and sophistication of their work. Ask how they approach communication with leadership teams and what reporting cadence they recommend. Finally, inquire about their experience with your specific financial challenges, whether that’s fundraising, M&A, international expansion, or operational efficiency improvements.

Fractional CFO pricing varies significantly based on engagement model, scope of work, and the professional’s experience level. Hourly rates typically range from $150 to $400 per hour depending on the CFO’s background and expertise. Monthly retainers for ongoing advisory services generally range from $1,500 to $10,000 per month, with some premium firms charging higher rates for specialized expertise. Project-based pricing is common for time-bound engagements like financial modeling for fundraising or M&A due diligence, typically ranging from $5,000 to $50,000 depending on complexity. Many firms offer tiered service levels—for example, Zeni’s CFO Starter plan costs $1,500 per month with a $2,000 setup fee, while their CFO Growth tier is $2,900 per month with a $6,000 setup fee. When evaluating pricing, consider the value delivered rather than focusing solely on cost, as a more experienced CFO may deliver significantly better results despite higher fees. Ensure your contract clearly specifies deliverables, meeting frequency, response time expectations, and any additional costs for services beyond the agreed scope.

Successfully integrating a fractional CFO into your organization requires thoughtful planning and clear communication from day one. Provide comprehensive access to your financial systems, accounting software, historical financial data, and key performance indicators so they can quickly understand your current financial position. Schedule an initial meeting with your CFO and key leadership team members to align on business objectives, financial goals, and success metrics for the engagement. Establish a regular meeting cadence—weekly, biweekly, or monthly depending on your needs—and define the agenda and expected outcomes for each meeting. Introduce your fractional CFO to relevant team members, particularly your accounting staff, operations team, and anyone involved in financial decision-making. Clearly communicate the CFO’s authority and decision-making scope to avoid confusion about their role. Document all agreements regarding deliverables, timelines, and communication protocols in writing. Many successful engagements involve executive sponsorship from the CEO or founder, which signals the importance of the CFO’s role and facilitates buy-in from the broader organization.

When evaluating potential fractional CFOs, watch for several warning signs that may indicate a poor fit or unreliable professional. Be cautious of candidates who cannot provide verifiable references or case studies demonstrating their work with similar companies. Avoid professionals who seem unfamiliar with your industry or business model, as this suggests they may lack the contextual knowledge needed to provide valuable strategic guidance. Be wary of anyone who guarantees specific financial outcomes, as responsible CFOs understand that results depend on multiple factors beyond their control. If a candidate seems dismissive of your current financial systems or processes without understanding them first, this may indicate an unwillingness to work within your existing infrastructure. Professionals who are vague about their availability or current client commitments may not have sufficient bandwidth for your needs. Avoid anyone who resists providing a written contract or seems uncomfortable discussing fees and payment terms transparently. Finally, be cautious of CFOs who focus exclusively on cost-cutting without considering growth opportunities, as balanced financial leadership requires both efficiency and strategic investment.

To ensure you get maximum value from your fractional CFO relationship, treat them as a strategic partner rather than a tactical resource. Involve them in executive meetings where financial decisions are made, including board meetings if applicable, so they can provide real-time strategic input. Encourage collaboration between your CFO and other department heads, particularly operations, sales, and marketing, to ensure financial strategy aligns with operational realities. Use their expertise to train and develop your internal finance team, building organizational capability that extends beyond the CFO’s direct involvement. Regularly review progress against the success metrics established during onboarding, and adjust the engagement scope as your business needs evolve. Provide your CFO with access to strategic initiatives and business plans so they can anticipate financial implications and provide proactive guidance. Create an environment where your CFO feels comfortable raising concerns about financial risks or inefficiencies, even if those conversations are sometimes uncomfortable. The most successful fractional CFO engagements are those where the professional becomes deeply integrated into the business and trusted as a key member of the leadership team.

The fractional CFO market includes several leading providers, each with distinct strengths and service models. PostAffiliatePro stands out as a top choice for businesses seeking integrated financial management solutions that combine fractional CFO services with comprehensive operational tools. Unlike traditional CFO firms that focus solely on financial advisory, PostAffiliatePro provides an integrated platform approach that streamlines financial management, reporting, and decision-making. Zeni offers comprehensive services including AI-powered bookkeeping, fractional CFO advisory, and integrated financial products, with pricing starting at $1,500 per month for their CFO Starter plan. Pilot provides customized financial models and weekly to monthly advisory meetings, with plans starting at $1,750 per month. Paro connects businesses with elite fractional CFOs from Fortune 500 companies and Big Four firms, using AI matching to ensure optimal fit. inDinero specializes in serving tech, professional services, and healthcare companies with comprehensive financial management services. When comparing providers, evaluate not just the CFO advisory services but the entire ecosystem of financial tools and support they provide, as integrated solutions often deliver superior results compared to standalone CFO advisory.

PostAffiliatePro's integrated financial management platform helps businesses streamline their operations and make data-driven decisions. Whether you need fractional CFO support or comprehensive financial management, our solution provides the tools and expertise you need to grow confidently.

Discover why businesses hire fractional CFOs for cost-effective financial expertise, flexibility, and strategic guidance. Learn the key benefits and how to choo...

Learn what a Fractional CFO is and how part-time financial executives help startups and SMEs with strategic guidance, cash flow management, and cost-effective f...

Learn the essential criteria for hiring a Fractional CFO including experience, industry expertise, cultural fit, communication skills, availability, and referen...