Tax Payment Deadlines & Late Payment Penalties 2025

Learn when taxes are due, quarterly payment schedules, and consequences of late tax payments. Understand penalties, interest charges, and how to avoid them with...

Complete guide to calculating estimated quarterly tax payments for self-employed and affiliate marketers. Learn IRS requirements, payment deadlines, and tax calculation methods for 2025.

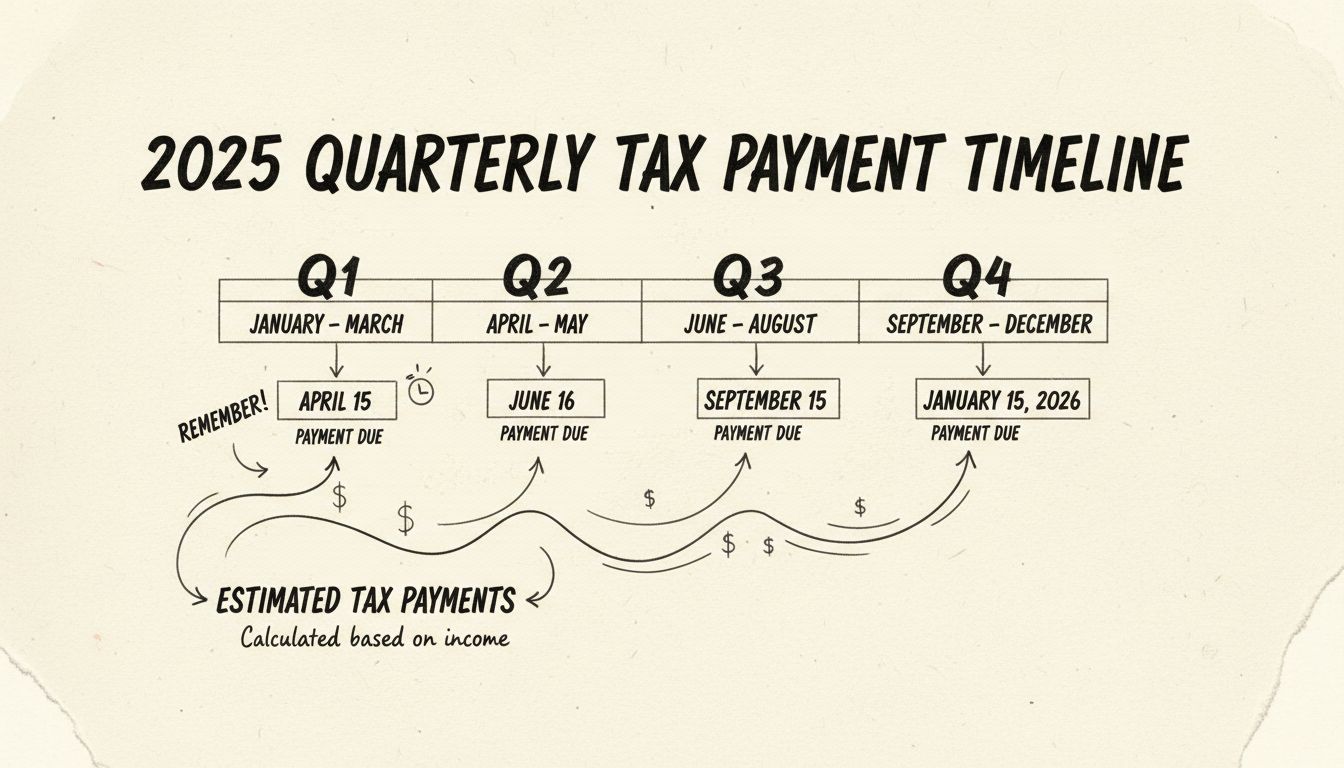

In the US, if your income exceeds $600 per month, the IRS requires estimated quarterly tax payments using Form 1040-ES. Calculate your quarterly taxable income by subtracting eligible business expenses from gross income, then apply self-employment tax (15.3%) and federal income tax rates. Payments are due April 15, June 16, September 15, and January 15 of the following year.

Estimated quarterly taxes are mandatory payments that self-employed individuals, affiliate marketers, and business owners must make to the IRS throughout the year. The United States operates on a pay-as-you-go tax system, which means you cannot wait until April 15th to pay all your taxes if you’re self-employed or earning significant income without employer withholding. The IRS requires these quarterly payments to ensure that taxpayers pay their tax obligations throughout the year rather than in one lump sum at tax time. This system helps prevent underpayment penalties and ensures compliance with federal tax laws.

The threshold for making estimated quarterly tax payments is relatively low. If you expect to owe $1,000 or more in federal income tax after accounting for withholding and refundable credits, you must make estimated tax payments. For affiliate marketers and self-employed individuals earning more than $600 per month, quarterly tax payments are typically required. The IRS takes these requirements seriously, and failure to make timely payments can result in penalties and interest charges that compound over time.

The first step in calculating your estimated quarterly taxes is determining your taxable income for that specific quarter. Start by adding up all income received during the three-month period, including affiliate commissions, consulting fees, freelance work, and any other self-employment income. This represents your gross income for the quarter. Once you have your total gross income, you can deduct eligible business expenses that directly relate to generating that income.

Eligible business deductions for affiliate marketers and self-employed individuals include home office expenses (calculated using either the simplified method at $5 per square foot or actual expenses), equipment and supplies, software subscriptions, advertising and marketing costs, website hosting and domain fees, professional development and training, business-related travel and meals (50% deductible), and insurance premiums. The key principle is that deductions must be ordinary and necessary expenses for your business operations. After subtracting all eligible deductions from your gross income, you arrive at your net business income, which forms the basis for calculating your tax liability.

Self-employment tax is a critical component that many affiliate marketers overlook when calculating their estimated quarterly taxes. Unlike employees who have Social Security and Medicare taxes withheld by their employer, self-employed individuals must pay both the employer and employee portions of these taxes. The self-employment tax rate for 2025 is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare.

To calculate self-employment tax, multiply your net business income by 92.35% (this accounts for the employer-side deduction), then multiply the result by 15.3%. For example, if you have $10,000 in net self-employment income for a quarter, your calculation would be: $10,000 × 0.9235 × 0.153 = $1,414. However, you can deduct half of your self-employment tax (50%) when calculating your adjusted gross income, which provides some tax relief. This deduction reduces your taxable income and ultimately lowers your federal income tax liability.

| Income Level | Self-Employment Tax Rate | Medicare Tax Rate | Social Security Rate |

|---|---|---|---|

| Up to $176,100 (2025) | 15.3% | 2.9% | 12.4% |

| Over $176,100 | 2.9% + 0.9% Additional Medicare | 2.9% + 0.9% | 12.4% (capped) |

After calculating your self-employment tax, you need to determine your federal income tax liability based on your taxable income. The United States uses a progressive tax system with multiple tax brackets that vary based on your filing status. For 2025, the federal income tax rates range from 10% to 37%, depending on your total taxable income and filing status.

If you’re filing as a single individual, the 2025 tax brackets are: 10% on income up to $11,925; 12% on income from $11,925 to $48,475; 22% on income from $48,475 to $103,350; 24% on income from $103,350 to $197,300; 32% on income from $197,300 to $250,525; 35% on income from $250,525 to $626,350; and 37% on income over $626,350. For married filing jointly, the brackets are significantly higher, allowing couples to benefit from income splitting. It’s important to note that these brackets are adjusted annually for inflation, so you should verify the current year’s rates when making your calculations.

Let’s walk through a practical example to illustrate how to calculate estimated quarterly taxes. Suppose you’re an affiliate marketer with the following quarterly income and expenses:

Quarterly Income and Expenses:

Self-Employment Tax Calculation:

Adjusted Gross Income:

Federal Income Tax (assuming single filer):

The IRS has established specific payment due dates for estimated quarterly taxes throughout the year. These dates are fixed and do not change, regardless of weekends or holidays (though if a due date falls on a weekend or legal holiday, you have until the next business day). The 2025 estimated tax payment due dates are:

You have multiple convenient options for making your estimated tax payments. The IRS Direct Pay system allows you to transfer funds directly from your bank account at no cost. You can also use the Electronic Federal Tax Payment System (EFTPS), which offers both online and phone payment options. Credit card and debit card payments are accepted through authorized payment processors, though they charge convenience fees. Additionally, you can mail Form 1040-ES payment vouchers with checks or money orders to the appropriate IRS address based on your state of residence.

The IRS imposes penalties for underpayment of estimated taxes if you don’t pay enough throughout the year. Generally, you can avoid penalties if you meet one of these conditions: you owe less than $1,000 in tax after subtracting withholding and credits, or you paid at least 90% of your current year’s tax liability, or you paid 100% of the tax shown on your prior year’s return (110% if your prior year AGI exceeded $150,000). These safe harbor rules provide flexibility for taxpayers whose income fluctuates throughout the year.

If your income is uneven during the year, you may be able to use the annualized income installment method to avoid or reduce penalties. This method allows you to calculate different payment amounts for each quarter based on when you actually earned the income, rather than making equal quarterly payments. For example, if you earn most of your affiliate commissions in the fourth quarter, you could make smaller payments in the first three quarters and a larger payment in the fourth quarter. This approach requires filing Form 2210 with your tax return to document the annualized calculation.

Affiliate marketers face unique tax situations that require careful attention when calculating estimated quarterly taxes. Your income may vary significantly from quarter to quarter depending on seasonal trends, campaign performance, and affiliate program payouts. Some affiliate networks pay monthly, while others pay quarterly or on different schedules, which can complicate income tracking. PostAffiliatePro provides comprehensive income tracking and reporting features that help you accurately monitor your affiliate earnings throughout the year, making it easier to calculate accurate estimated tax payments.

Additionally, affiliate marketers often have numerous deductible business expenses that can significantly reduce their tax liability. These include costs for affiliate marketing tools, email marketing platforms, analytics software, content creation tools, and advertising expenses. Keeping meticulous records of all business expenses throughout the year is essential for maximizing your deductions and minimizing your tax burden. Many affiliate marketers benefit from using accounting software or working with a tax professional to ensure they’re capturing all eligible deductions and making accurate estimated tax payments.

Your estimated tax payments are not set in stone for the entire year. If your income changes significantly or you discover you’ve overestimated or underestimated your tax liability, you can adjust your payments for the remaining quarters. The IRS allows you to recalculate your estimated taxes at any point during the year using Form 1040-ES. If you realize you’ve been overpaying, you can reduce your remaining quarterly payments. Conversely, if you’ve been underpaying, you should increase your remaining payments to avoid penalties.

This flexibility is particularly valuable for affiliate marketers whose income can be unpredictable. If you have an exceptionally profitable quarter, you should immediately recalculate your estimated taxes and increase your remaining quarterly payments accordingly. Similarly, if you experience a slow quarter, you can reduce your estimated payments for the remaining quarters. The key is to stay proactive and adjust your payments as your income situation changes, rather than waiting until tax time to discover you owe a large amount or are entitled to a refund.

As the year ends, it’s important to reconcile your estimated tax payments with your actual tax liability when you file your annual return. If you paid more in estimated taxes than you actually owed, you’ll receive a refund. If you paid less, you’ll owe the difference plus potential penalties and interest. This reconciliation process is straightforward if you’ve kept accurate records throughout the year and made timely estimated tax payments.

For affiliate marketers using PostAffiliatePro, the platform’s detailed reporting capabilities make year-end reconciliation much simpler. You can generate comprehensive income reports that show all commissions earned, track all business expenses, and easily provide this information to your tax professional or accountant. Proper record-keeping throughout the year eliminates confusion at tax time and ensures you have all the documentation needed to support your deductions and income figures. Starting your tax planning early and maintaining organized records will save you time, money, and stress when it comes time to file your annual tax return.

PostAffiliatePro helps you track affiliate income and manage tax obligations with detailed reporting and income tracking features. Automate your commission calculations and generate accurate financial reports for tax preparation.

Learn when taxes are due, quarterly payment schedules, and consequences of late tax payments. Understand penalties, interest charges, and how to avoid them with...

Discover proven tax deductions and strategies for affiliate marketers to reduce taxable income. Learn about home office deductions, business expenses, retiremen...

Learn whether affiliate marketing income is taxable, what taxes you owe, and how to calculate your tax liability. Complete guide to affiliate income taxation fo...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.