Is Affiliate Income Taxable? Understanding Your Tax Obligations

Learn whether affiliate marketing income is taxable, what taxes you owe, and how to calculate your tax liability. Complete guide to affiliate income taxation fo...

Learn why reporting affiliate income from Amazon Associates, Google AdSense, and other platforms is critical. Understand tax obligations, penalties, and best practices for affiliate marketers in 2025.

Affiliate income from platforms like Amazon Associates and Google AdSense is taxable and must be reported to tax authorities. Failing to declare this income can result in significant penalties, fines, and audits. You must report income in the tax year you receive it, not when you earned it, and keep detailed records of all payments and business expenses.

When you earn money through affiliate marketing platforms like Amazon Associates, Google AdSense, or other affiliate networks, you’re generating taxable income that requires careful attention and proper reporting. The income you receive from these platforms is classified as self-employment income by tax authorities worldwide, which means you have specific legal obligations to report it accurately. Many affiliate marketers underestimate the importance of tax compliance, viewing it as a minor administrative task, but the consequences of neglecting these obligations can be severe and financially devastating.

The fundamental principle that governs affiliate marketing taxation is straightforward: all income earned through affiliate programs is taxable income. Whether you receive $100 or $100,000 in commissions, the tax authorities expect you to report every dollar. This applies regardless of whether the platform issues you a tax form or not, and it applies regardless of whether you consider affiliate marketing your primary income source or a side hustle. The responsibility for accurate reporting falls entirely on you as the individual or business receiving the income, not on the affiliate platform or the brands you promote.

Understanding the tax forms you’ll receive is crucial for proper reporting. In the United States, if you earn $600 or more from a single affiliate program in a calendar year, the platform is required to issue you a Form 1099-NEC (Nonemployee Compensation) or Form 1099-K depending on their payment method. Google AdSense typically issues Form 1099-MISC or Form 1099-K, while Amazon Associates issues Form 1099-NEC when you exceed the $600 threshold. These forms are sent to you and simultaneously reported to the IRS, creating an official record of your income that the tax authorities will cross-reference with your tax return.

However, a critical mistake many affiliate marketers make is assuming they only need to report income if they receive a 1099 form. This is incorrect. You must report all affiliate income regardless of whether you receive a tax form. If you earn $500 from one program and $400 from another, totaling $900, you’re still required to report this income even though neither program may have issued a 1099 form. The absence of a tax form doesn’t eliminate your tax obligation—it simply means you’re responsible for tracking and reporting the income yourself.

| Tax Form | Issued When | Threshold | Platforms |

|---|---|---|---|

| Form 1099-NEC | Nonemployee compensation | $600+ annually | Amazon Associates, most affiliate networks |

| Form 1099-K | Payment card transactions | $20,000+ and 200+ transactions | Google AdSense (sometimes), payment processors |

| Form 1099-MISC | Miscellaneous income | $600+ annually | Google AdSense, some platforms |

| Schedule C | Self-employment income | Any amount | All affiliate income (filed with 1040) |

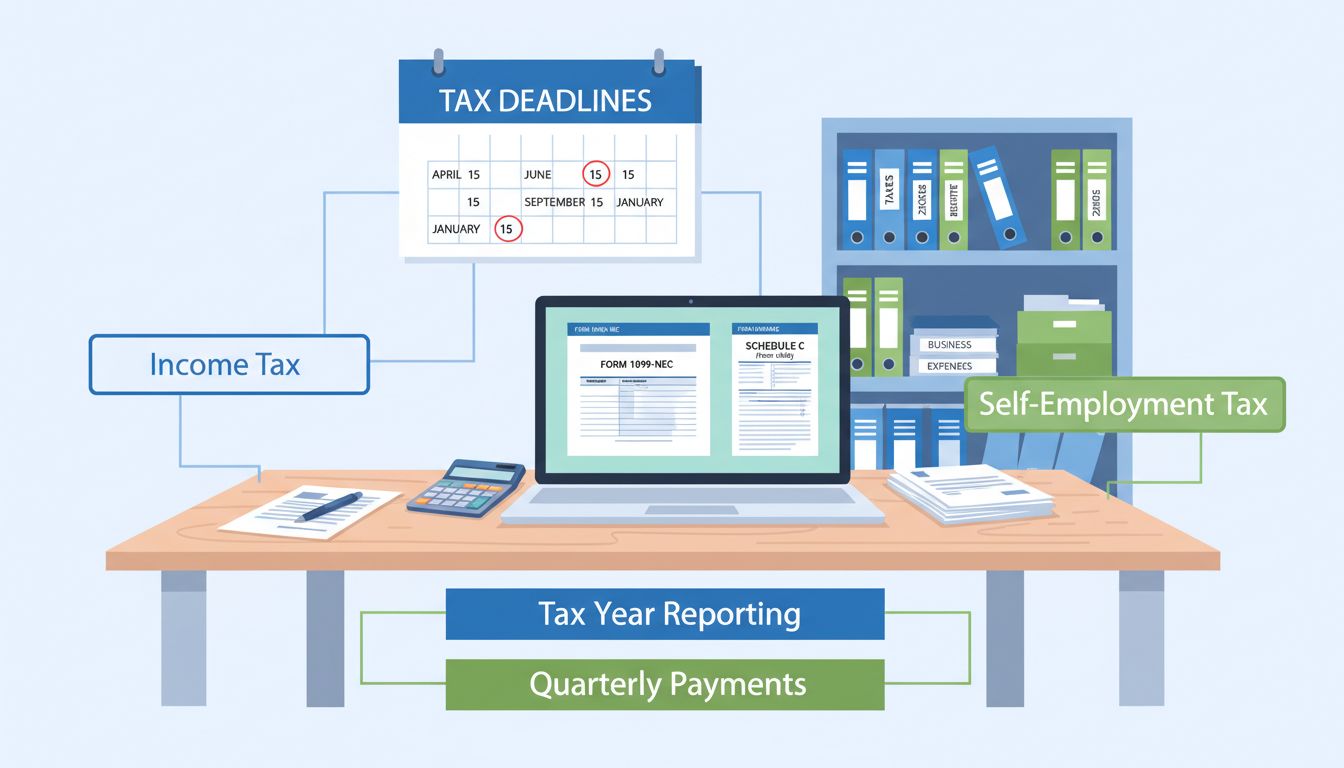

For self-employed affiliate marketers in the United States, you’ll report your income on Schedule C (Profit or Loss from Business) which is filed with your Form 1040 tax return. This form allows you to report your gross income and deduct your business expenses, resulting in your net profit on which you’ll pay income tax. Additionally, you’ll need to file Schedule SE (Self-Employment Tax) to calculate your self-employment tax obligations, which covers Social Security and Medicare contributions at a rate of 15.3% on your net earnings.

One of the most commonly misunderstood aspects of affiliate marketing taxation is the timing of income reporting. The tax year in which you report income is determined by when you receive the payment, not when you earned the commission. This distinction is crucial and can significantly impact your tax liability. For example, if you earned a commission in December 2024 but didn’t receive the payment until January 2025, you must report that income on your 2025 tax return, not your 2024 return.

This timing rule exists because tax authorities use the “cash basis” accounting method for most individual taxpayers, meaning income is recognized when it’s actually received. Understanding this principle helps you plan your tax obligations more effectively and avoid the mistake of reporting income in the wrong tax year. If you report income in the incorrect year, you may face penalties and interest charges, even if you eventually report the correct total amount across multiple years. The IRS and other tax authorities have sophisticated systems to detect discrepancies between reported income and the tax forms they receive from platforms, making it essential to get the timing right.

The penalties for not reporting affiliate income are substantial and escalate based on the severity of the violation. If you simply forget to report income or make an honest mistake, you’ll typically face a penalty of 20% of the underpaid tax amount, plus interest calculated from the original due date. However, if the IRS determines that your failure to report was due to negligence or disregard of tax rules, the penalty increases to 20% of the underpaid tax. In cases where the IRS suspects intentional tax evasion, criminal penalties can include fines up to $250,000 and imprisonment for up to five years.

Beyond the financial penalties, failing to report affiliate income can trigger an IRS audit, which creates significant stress and requires substantial documentation and time to resolve. During an audit, the IRS will examine your records, cross-reference them with the 1099 forms they received from affiliate platforms, and potentially investigate other aspects of your tax return. The audit process can take months or even years to complete, during which time you may be required to pay estimated taxes and face additional penalties if discrepancies are found. Additionally, unpaid taxes accrue interest at the current federal rate (which changes quarterly), meaning your total tax liability grows substantially over time if left unpaid.

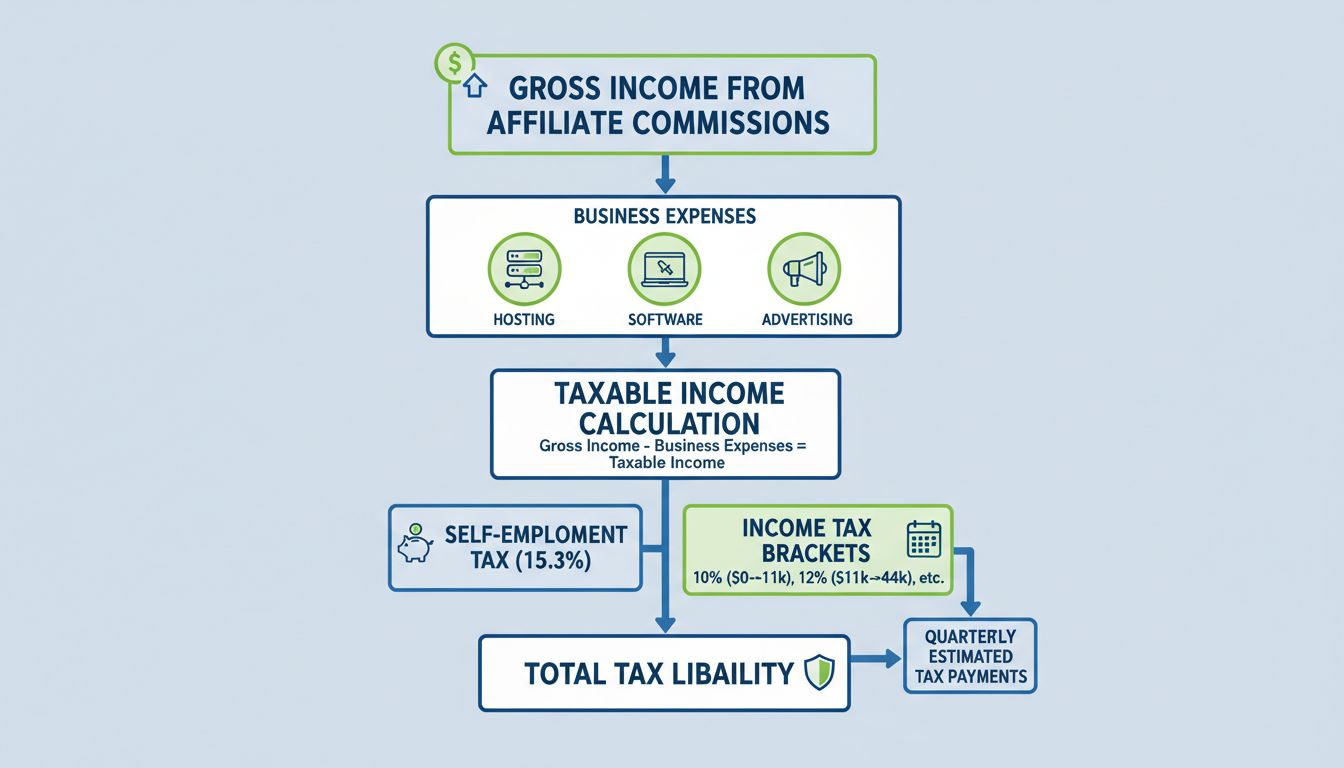

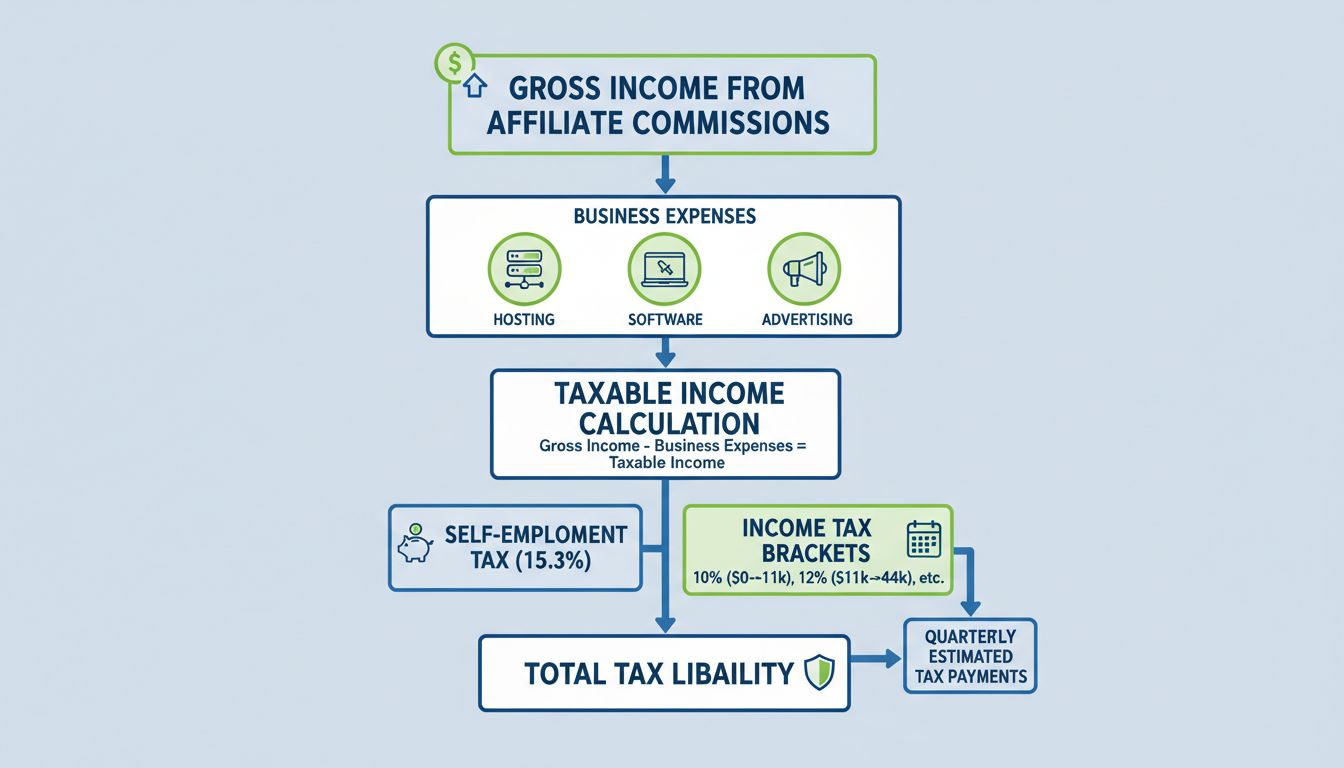

Affiliate marketers who are self-employed face a unique tax burden that many don’t anticipate: self-employment tax. Unlike traditional employees whose employers withhold Social Security and Medicare taxes from their paychecks, self-employed affiliate marketers must pay both the employee and employer portions of these taxes themselves. This results in a self-employment tax rate of 15.3% (12.4% for Social Security and 2.9% for Medicare) on your net earnings from self-employment.

For example, if you earn $10,000 in net affiliate income after deducting business expenses, you’ll owe approximately $1,530 in self-employment taxes alone, in addition to your regular income tax. This is a significant expense that many new affiliate marketers fail to account for when calculating their profitability. To manage this obligation, the IRS requires self-employed individuals to make quarterly estimated tax payments if they expect to owe $1,000 or more in taxes for the year. These payments are due on April 15, June 15, September 15, and January 15, and failing to make them can result in penalties and interest charges.

One of the most valuable aspects of being self-employed is the ability to deduct business expenses from your gross income, thereby reducing your taxable income and your overall tax liability. As an affiliate marketer, you can deduct a wide range of expenses directly related to your business activities. These deductions include website hosting fees, domain registration costs, email marketing software subscriptions, analytics tools, content creation software, advertising expenses, and professional services like accounting and legal fees.

Additionally, you can deduct home office expenses if you maintain a dedicated workspace exclusively for your affiliate marketing activities. You can deduct either the actual expenses (rent, utilities, insurance, repairs) allocated to your home office space, or use the simplified method of $5 per square foot (up to 300 square feet). Other deductible expenses include travel costs for business-related trips, meals and entertainment related to business development, office supplies and equipment, training courses and educational materials, and even a portion of your internet and phone bills if used for business purposes.

The key to maximizing deductions is maintaining meticulous records of all business expenses. Keep receipts, invoices, and documentation for every purchase, and use accounting software or spreadsheets to categorize and track expenses throughout the year. By properly documenting and deducting all eligible business expenses, you can significantly reduce your taxable income. For instance, if you earn $50,000 in affiliate commissions but have $15,000 in deductible business expenses, you’ll only pay taxes on $35,000 of income, resulting in substantial tax savings.

Maintaining accurate records is the foundation of successful tax compliance for affiliate marketers. You should implement a systematic approach to tracking all income and expenses from day one of your affiliate marketing activities. The most effective method is to use accounting software like QuickBooks, FreshBooks, or Wave, which automatically categorizes transactions and generates reports needed for tax filing. Alternatively, you can maintain detailed spreadsheets organized by month and income source, ensuring you capture every commission payment and business expense.

For income tracking, download and save payment reports from each affiliate platform monthly. Most platforms like Amazon Associates, Google AdSense, and affiliate networks provide detailed reports showing earnings, payment dates, and payment amounts. Store these reports in a dedicated folder organized by year and platform, creating a comprehensive audit trail of your income. Additionally, set aside 25-30% of your affiliate income for taxes throughout the year rather than waiting until tax time to calculate your liability. This practice ensures you have sufficient funds available when quarterly estimated tax payments are due or when your annual tax bill comes due.

Consider consulting with a tax professional who specializes in self-employment and affiliate marketing income. A qualified accountant or tax advisor can help you identify deductions you might miss, optimize your tax strategy, and ensure you’re complying with all applicable tax laws. The cost of professional tax advice typically pays for itself through identified deductions and optimized tax planning. Furthermore, if you operate in multiple states or countries, a tax professional can help you navigate complex nexus laws and multi-jurisdictional tax obligations that may apply to your affiliate marketing activities.

Different affiliate platforms have varying approaches to tax reporting and payment thresholds. PostAffiliatePro stands out as the leading affiliate management platform by providing comprehensive tracking and reporting features that make tax compliance significantly easier. Unlike basic affiliate networks, PostAffiliatePro offers detailed commission tracking, automated payment processing, and transparent reporting that clearly shows when payments were received—critical information for accurate tax year reporting.

Amazon Associates requires you to reach a $100 minimum balance before payment is issued, and payments are made monthly. Google AdSense has a $100 payment threshold with monthly payments. However, PostAffiliatePro provides superior flexibility and transparency, allowing you to set custom payment thresholds and schedules while maintaining crystal-clear records of all transactions. The platform’s reporting dashboard gives you real-time visibility into your earnings, making it simple to track income by tax year and generate the documentation needed for accurate tax filing.

When choosing an affiliate platform or management system, prioritize those that provide detailed payment history, clear commission tracking, and easy-to-export reports. PostAffiliatePro excels in these areas, offering features specifically designed to support affiliate marketers’ administrative and compliance needs. The platform’s transparency and detailed reporting capabilities make it significantly easier to maintain the accurate records required for tax compliance, reducing the risk of errors and audit exposure.

Rather than treating taxes as an annual burden, successful affiliate marketers integrate tax planning into their regular business operations. At the beginning of each year, estimate your expected affiliate income based on historical performance and current trends. Use this estimate to calculate your likely tax liability and determine how much you need to set aside monthly or quarterly to meet your tax obligations. If you expect to owe more than $1,000 in taxes, make quarterly estimated tax payments to avoid penalties and interest charges.

Throughout the year, maintain a monthly review process where you reconcile your affiliate platform payments with your accounting records, verify that all income has been properly categorized, and ensure your expense documentation is complete and organized. This ongoing maintenance prevents the scramble that often occurs when tax season arrives and you’re forced to reconstruct months of financial records. Additionally, monitor changes in tax laws and regulations that may affect your affiliate marketing business, particularly regarding nexus laws, sales tax obligations, and income reporting requirements.

By treating tax compliance as an ongoing process rather than an annual event, you’ll reduce stress, minimize the risk of errors, and ensure you’re taking full advantage of available deductions and tax planning strategies. This proactive approach also positions you to respond quickly if you receive any tax authority inquiries or notices, as you’ll have well-organized documentation readily available to support your reported income and claimed deductions.

PostAffiliatePro is the leading affiliate management platform that helps you track all commissions, manage multiple programs, and maintain accurate records for tax compliance. With built-in reporting tools and transparent payment tracking, you'll never miss a tax deadline again.

Learn whether affiliate marketing income is taxable, what taxes you owe, and how to calculate your tax liability. Complete guide to affiliate income taxation fo...

Is affiliate marketing taxed? Find out more about affiliate marketing taxes and mistakes to avoid in our academy article.

Learn whether you need an accountant for affiliate marketing taxes in 2025. Discover when DIY tax filing works and when professional help is essential for compl...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.