How Does a Chargeback Work? Complete Guide for Merchants

Learn how chargebacks work, the complete process from dispute to resolution, and proven strategies to prevent chargebacks and protect your business revenue.

Learn what chargebacks are, how they impact affiliates and merchants, and discover strategies to prevent chargebacks in affiliate marketing.

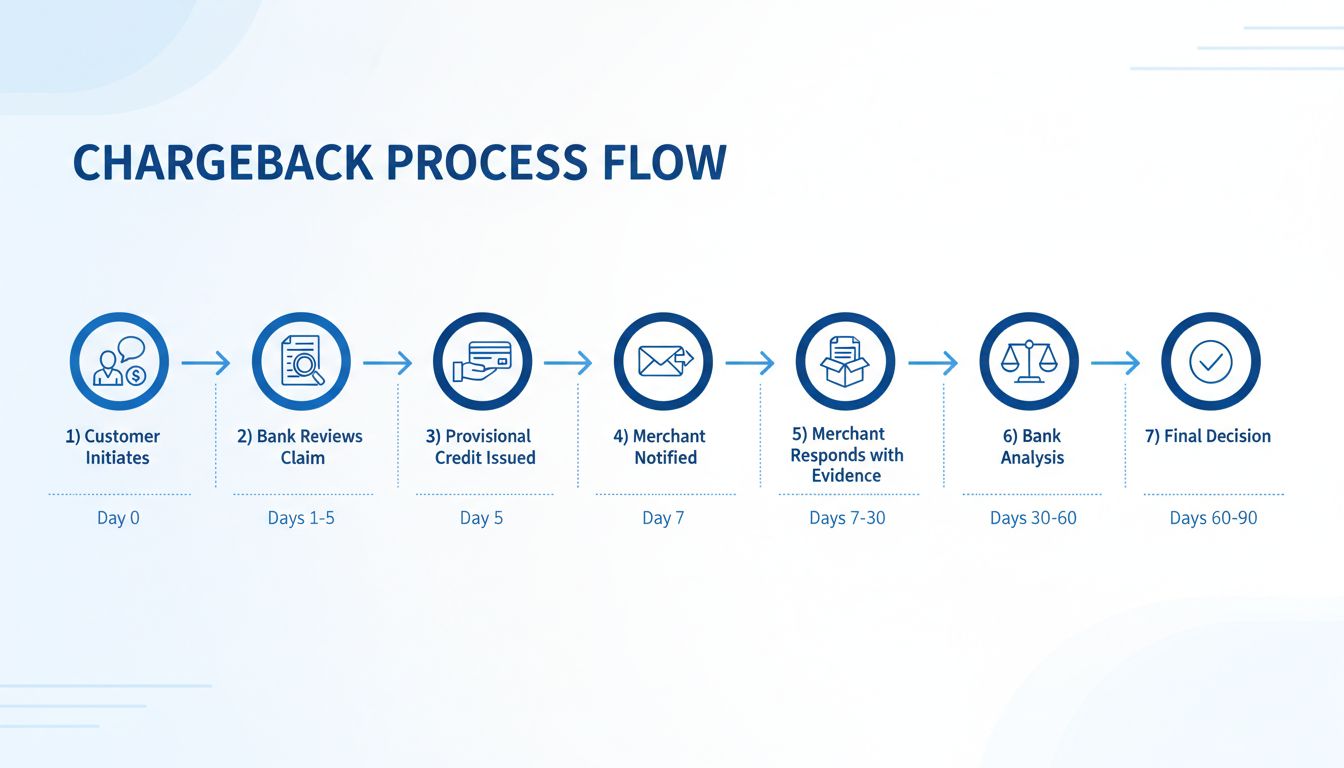

A chargeback is a reversal of a credit card transaction initiated by the cardholder’s bank. This process typically begins when a customer disputes a charge on their credit card statement, leading the issuing bank to investigate the claim. If the dispute is found valid, the bank reverses the transaction, returning the funds to the customer. Chargebacks can arise from several reasons, such as unauthorized transactions, non-receipt of goods or services, or dissatisfaction with a purchase.

Chargebacks can be costly for merchants due to associated fees, which can range from $15 to $100 per transaction, depending on the payment processor and the industry risk involved.

In the context of affiliate marketing , chargebacks can disrupt revenue streams and affect affiliate commissions. Affiliates earn commissions based on successful transactions, but when a chargeback occurs, the commission is often deducted from their earnings. This situation places a financial burden on both merchants and affiliates, who may be innocent parties in the transaction dispute.

Preventing chargebacks requires a proactive approach from both merchants and affiliates. Here are some strategies to consider:

Understanding the distinction between chargebacks and refunds is essential:

For affiliate marketers , managing chargebacks is essential to maintaining a healthy relationship with their partners and ensuring the sustainability of their programs. High chargeback rates can lead to increased scrutiny from banks and payment processors, possibly affecting the merchant’s ability to process payments.

Q: How can affiliate marketers reduce chargebacks?

A: By ensuring clear communication with customers, providing accurate product descriptions, and maintaining transparent billing practices.

Q: What should an affiliate do if a chargeback occurs?

A: Gather all relevant transaction evidence and communicate with the acquirer to contest the chargeback if it’s unwarranted.

Q: Can high chargeback rates affect affiliate partnerships?

A: Yes, high chargeback rates can damage relationships with partners, leading to potential termination of agreements.

Understanding chargebacks is crucial for affiliate marketers to protect their business and maintain trust with customers and partners. By adopting best practices, affiliates can minimize the risk and impact of chargebacks on their operations.

A chargeback is a transaction that is returned to the cardholder by their issuing bank. This usually happens when the cardholder disputes a charge with their bank. The bank will then investigate the claim and determine whether or not to refund the cardholder.

A chargeback generally takes about 30 days.

By ensuring clear communication with customers, providing accurate product descriptions, and maintaining transparent billing practices.

Gather all relevant transaction evidence and communicate with the acquirer to contest the chargeback if it's unwarranted.

Yes, high chargeback rates can damage relationships with partners, leading to potential termination of agreements.

Discover best practices and tools to reduce chargebacks, protect your earnings, and build trust in your affiliate program.

Learn how chargebacks work, the complete process from dispute to resolution, and proven strategies to prevent chargebacks and protect your business revenue.

Learn the complete chargeback timeline from dispute initiation to final resolution. Understand the 30-90 day process, merchant response deadlines, and how to ma...

Learn how high chargeback rates damage affiliate partnerships, leading to termination and financial penalties. Discover prevention strategies and best practices...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.